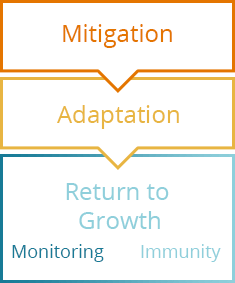

The Three Phases

We view the disruptions from COVID-19 in three distinct phases of economic activity: Mitigation, Adaptation, and the eventual Return to Growth.

During the Mitigation phase, companies must take quick defensive measures like freezing hiring, reducing headcount, eliminating riskier lines of business, and freezing investments. Most companies likely went through this phase in March/April, but there are still some firms that have not taken steps to mitigate the damage.

During the Adaption phase, we expect to see firms build a new understanding of their marketplaces. This downturn has caused shifts to how business is transacted, and firms will spend this phase adjusting their processes and services to satisfy these new ways of doing business.

The final phase, the Return to Growth, is where companies begin to see a light at the end of this tunnel and begin investing again for growth rather than maintenance. Here hiring picks up, investments are resumed, and managers become more comfortable with taking on risk.

Current Status

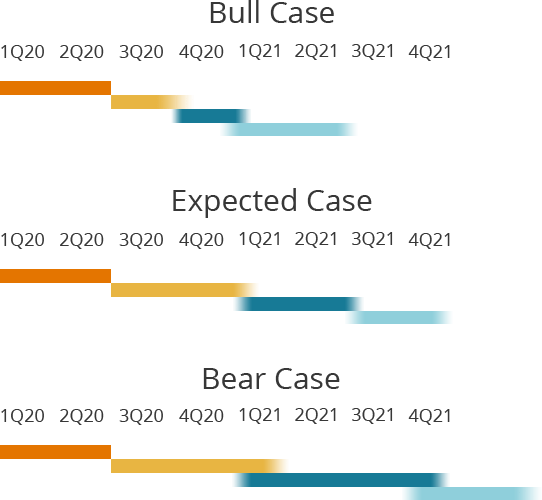

This economic shock appeared quickly, and it is cutting deeper than any recession since the Great Depression in 1929. While our expectations are that it will have three relatively distinct phases and be over relatively quickly, we are at the mercy of the speed of medical advances. The timing of these phases can be shortened by new therapeutics and/or vaccines, or they could be lengthened by evolutions of the virus, multiple infection waves, or elevated geopolitical risk resulting from the pandemic and its fallout.

Mitigation Phase

Adaptation Phase

Many are experiencing shocks to their sales pipeline and current contracts. Employee headcount reductions occur, and businesses require reorganization. Outlooks are at their most uncertain here, leading to firms preparing for the worst-case scenarios.

Key Features

- Economic activity muted

- Home isolation with “Stay at home” orders

- Only essential businesses / activities operating

- High economic uncertainty

During this phase, the initial shock has been absorbed and select businesses begin to reopen. The uncertainty around economic forecasts have narrowed but there is still significant risk in the market. Firms are now forced to adapt to this temporary new normal to weather the storm – changing how they operate, products and services offered, and their go-to-market strategy.

Key Features

- Economic activity is selectively brought back online

- PPE recommended everywhere

- Early-stage antibody testing / contact tracing

- Moderate economic uncertainty

Return to Growth Phase

We expect the return to growth to occur in two distinct stages, the monitoring stage and the immunity stage. Economies will begin reopening at a moderate pace before a vaccine is available with a true return to growth once mass immunity is achieved.

Monitoring

In this phase a significant portion of economic activity can return to operation. The major enablers of this phase will be mass antibody testing and mass contact tracing via apps and dedicated tracing teams. Essentially all small scale (fewer than 50-75 individuals) businesses and activities can operate.

Key Features

- Selectively reopened economies

- PPE recommended everywhere

- Mass antibody testing/contact tracing

- All small-scale (<50%-75%) businesses/activities open

- Moderate economic uncertainty

Immunity

The global economy will face continued headwinds until an effective vaccine has been developed and widely disseminated. Once this has occurred, we expect a full return to growth, but the time taken to return to pre-COVID levels will vary by industry. This pandemic has disproportionately impacted certain industries and even with unprecedented stimulus efforts, they will take time to recover.

Key Features

- Reopened economies

- PPE no longer necessary

- Mass antibody testing/contact tracing no longer necessary

- All businesses/activities open

- Normal economic uncertainty

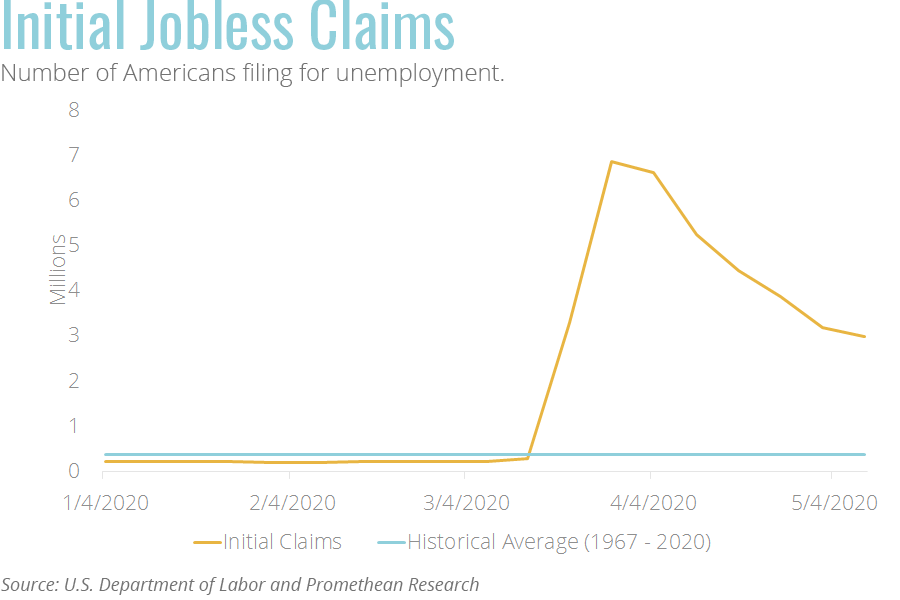

The Depth of the Recession

In order to understand how deep this recession could cut, we must examine the main drivers of the economy: Consumer spending (~70% of GDP) and business investment (~20% of GDP). Consumer spending is mainly driven by employment, wages, prices, interest rates, and consumer confidence. During this downturn, we expect to see negative pressure on employment, wages (slightly), prices (selectively), and consumer confidence. Interest rates were already close to historic lows prior to the pandemic. The most critical areas being employment and consumer confidence. Business investment will vary by industry as the downturn is having disproportionate effects.

Unemployment Levels

Second quarter unemployment levels are forecasted to be around 20%-30%. For context, the peak unemployment rate during the 1929 Great Depression was 24.9%. The main difference is the expected duration of the current economic decline versus other recessions. The Great Depression lasted a decade, fortunately, we do not expect this economic slowdown to last more than two years. The rate at which consumer spending returns will be the true limiting factor of the recovery. During this timeframe, we expect to see roughly half of the recently unemployed return to work. This would bring the unemployment rate down to the low double digits by the end of 2020. All the employment gains will increase consumer spending, which drives the U.S. economy.

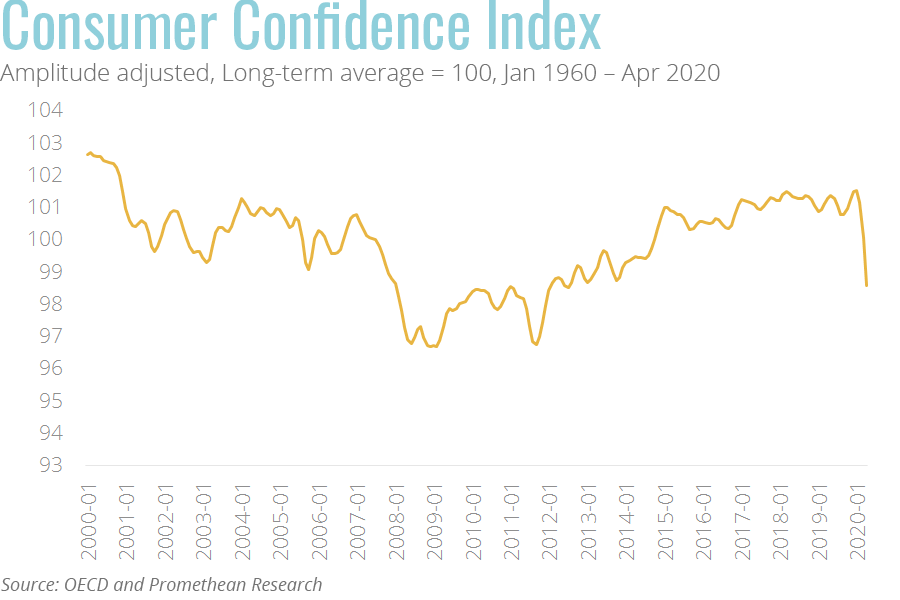

Consumer Confidence

Coinciding with the loss of millions of jobs, consumer confidence weakened significantly in March and fell to its lowest level in six years in April 2020. This sharp contraction reveals significant concern among American households, and we expect this sentiment will weigh on the recovery.

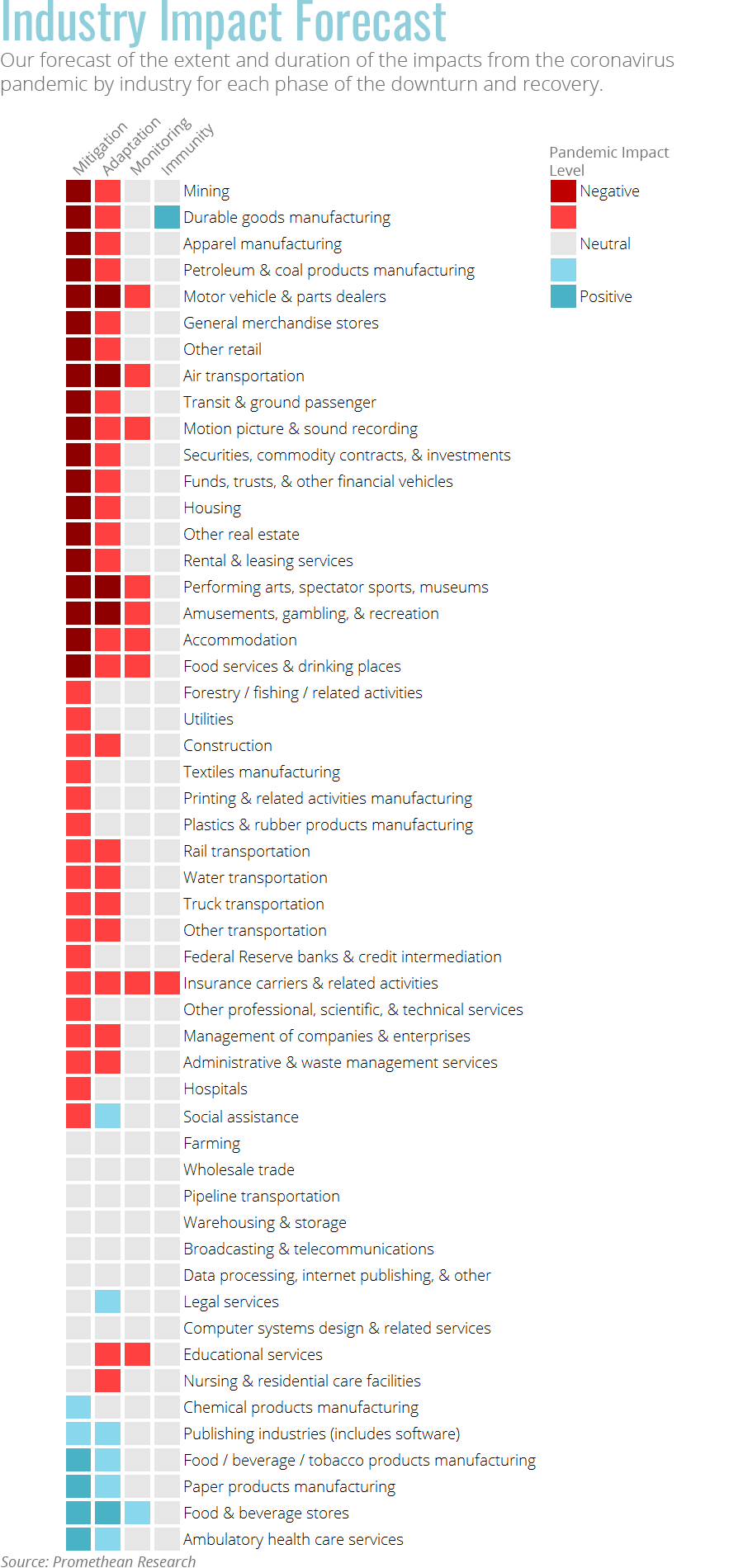

Affected Industries

This downturn has disproportionately affected many different industries and recoveries will be varied. The most seriously affected area so far (as of March 2020 data) has been Leisure & Hospitality, but we expect to see significant issues in other industries as the dominoes fall following the economic shutdowns. Here we provide our outlooks, by industry, for each phase of the downturn. See below for a quick analysis of each industry.

Agriculture, forestry, fishing, and hunting

We expect farming to remain relatively unimpacted throughout the downturn with a slight edge toward the downside. While there are issues in the supply chain, specifically around the processing stages, we expect these to be short-lived. Forestry, fishing and related activities should see a bit more negative impact initially, but these impacts should fade quickly.

Mining

This is an area that took two hits, from COVID-19 and an oil price war which weighted heavily on Oil and gas extraction. We expect this industry to do a bit better during the Adaptation phase but will not return to growth until 1H21 due to continued pressure from a surplus in supply.

Utilities

Utilities took an initial hit as businesses closed during the Mitigation phase, but this should lessen as businesses and offices reopen.

Construction

We expect an initial slowdown here that should persist through the Adaptation phase as parts of the industry were initially shut down. We expect these impacts to ease in early 2021 with a noted lag in demand for new office space offset by a potential increase in infrastructure spending.

Durable goods manufacturing

This industry experienced a major slowdown during the Mitigation phase that will likely drag through the Adaptation phase. We are looking for the negative impacts to fade in early 2021 and would expect positive impacts later that year as pent up demand drives a substantial rebound.

Nondurable goods manufacturing

- Food and beverage and tobacco products saw a major uptick during the Mitigation phase, and we expect this will continue, to a lesser extent, through the Adaptation phase. This area should normalize during the Return to Growth phase.

- Textile mills and textile product mills experienced shutdowns and weak demand during the Mitigation phase, but we expect a rapid return to normal with a socially distanced workforce and advanced automation.

- Apparel and leather and allied products experienced shutdowns during the Mitigation phase but some of this was offset by a shift to production of PPE (masks) during the Adaptation phase. These effects likely result in a net negative for the industry initially, but we expect these effects to dissipate in early 2021.

- Paper products manufacturers experienced an initial positive impact during the Mitigation phase, lessening in the Adaptation phase, and then falling during the return to growth phase. Roughly half of the global paper market by weight is comprised of packaging which we believe will experience an increased demand as more retail trade occurs online and transactions are shipped again individually.

- Printing and related support activities realized an initial negative impact during the Mitigation phase but should normalize throughout the rest of the pandemic. Significant portions of the outputs from this industry flow into other manufacturing areas which should experience early challenges, but we expect them to fade in early 2021.

- Petroleum and coal products suffered a double blow during the Mitigation phase as shutdowns and a price war in oil. As oil prices collapsed in March 2020, the demand for refining fell as well. As far as the impact here from the pandemic, we expect shutdowns to ease and impacts to decline by early 2021.

- Chemical products should experience a slight positive impact during the Mitigation phase as demand increased sharply for soaps, hand sanitizer, and pharmaceutical manufacturing. This positive impact should dissipate during the Adaptation phase as demand tapers.

- Plastics and rubber products activities will likely see negative impacts due to the shutdown cascading through end markets during the Mitigation phase. These will likely be partially offset by increased demand for PPE (face shields and gloves). These factors should net out to a minimal impact during the Adaptation and Return to Growth phases

Retail trade

As the U.S. experienced a 33% decline in vehicle sales during the month of March, which we expect further declines in April. This will likely lead to prolonged negative impacts in the Motor vehicle and parts dealers industry and do not expect these issues to dissipate until we are well into 2021.

Food and beverage stores experienced positive impacts during the Mitigation phase which we expect will continue through the Adaptation phase as consumers remain hesitant to shift their spending back to restaurants.

General merchandise stores and Other retail saw massive drops in revenue during the Mitigation phase as many were forced to close indoor operations and move to a curbside model. Going forward, consumer’s hesitancy to spend, due to uncertainty around the economy, will weigh on this industry. We expect to see these effects lessen during the Adaptation phase and finally become negligible in the Return to Growth phase.

Transportation and warehousing

Air transportation will have the toughest time of the group with major hits from drops in consumer and business travel demands. We expect to see significant negative impacts in this space through the Adaptation phase and even well into the Return to Growth phase. Rail, water, and truck transportation experienced negative impacts from the decline in business activity and consumer spend. These impacts are likely to be partially offset by an increase in consumers shopping online. We expect these negatives to persist through the Adaptation phase and dissipate in 1H21.

Information

“Publishing except internet (includes software)” should see a slight positive impact during the Mitigation and through the Adaptation phase because it includes software firms. The Motion picture and recording industry should see significant negative impacts from the pandemic as it typically requires content creators to be in close proximity in order to create the product. Couple that with the relatively short shelf life and the closure of theaters, and we expect to see the negative impacts persist through the first half of the 2021.

Finance and insurance

We are expecting to see significant challenges related to lending, both commercial and consumer, due to reduced creditworthiness from an unstable economy. This will weigh on banks even as they see an uptick in an increase in higher margin mobile and ATM transactions. These negative impacts will likely last though the Adaptation phase, clearing up in the Return to Growth phase. Reinsurers could be at risk if too many businesses file claims for revenue losses due to the pandemic which would strain the industry’s capital reserves. We see this persisting through the Return to Growth phase.

Real estate and rental and leasing

During the Mitigation phase, new home sales in March fell 15% M/M and 10% Y/Y and we expect April to be worse as shelter-in-place orders forced much of the country inside. The significant increase in the unemployment rate is increasing the risk of defaults and reducing the ability of renters to make rent. These negative impacts should lessen slightly during the Adaptation phase as government stimulus arrives and should dissipate substantially during 2021.

Professional and business services

Professional services are easily delivered remotely and much of the industry has experience in telework already. We expect to see minimal disruptions to the ability to supply services, but negatives on the demand side persist. A potential area of strength lies in Legal services during the Adaptation phase where many contracts (sales, lease, loans, employment, etc.) would be reconsidered.

Administrative and waste management had demand disruptions from the closer of businesses during the Mitigation phase. This will lessen slightly during the Adaptation phase and then should dissipate through the Return to Growth phase.

Educational services

Schools and universities went remote during the Mitigation phase but likely saw little immediate damage. Should colleges be forced to primarily offer remote classes during the Adaptation phase, we would expect to see significant downward pressure on their pricing ability. This, along with the lost revenue from sports, dorms, will likely cause challenges to persist through a significant portion of the Return to Growth phase.

Health care and social assistance

We expect to see positive impacts for ambulatory services during the Mitigation, and less so during the Adaptation phase. These should taper during the Return to Growth phase as demand returns to normal levels. Many hospitals were forced to close elective surgeries during the Mitigation phase which resulted in staff layoffs. We expect this negative impact to be short-lived with elective surgeries resuming during the Adaptation phase. A slight headwind for Nursing and residential care facilities during the Adaptation phase comes from significant risks associated with nursing homes but we see this abating quickly as few alternatives exist. Social assistance programs will be relied upon heavily during this pandemic and funding typically lags in this area. We would expect initial declines to dissipate as funding arrives and hiring increases during the Adaptation phase.

Arts, entertainment, and recreation

This industry saw widespread shutdowns and it is difficult to imagine a significant reemergence of demand before the risk of infection has declined. We expect to see continued headwinds here through the Adaptation phase, progressively lessening through the Return to Growth phase.

Accommodation and food service

A large portion of restaurants, a high volume / low margin business, are expected to close permanently during the Mitigation and Adaptation phases. Continued challenges from weak expected demand will likely persist though most of the Return to Growth phase.

Relief Efforts

The U.S. government has instituted multiple emergency relief efforts to reduce the negative impacts that the coronavirus is having on the economy.

Small Business Payroll Loans

Magnitude: Initial – $350B, Secondary – $310B

Expected impact: Low

Major issues with the small business payroll loan program have limited its effectiveness. There was a significant amount of confusion around the program and the process to apply during the first tranche of funding, and this was not made much clearer during the second tranche of funding. Estimates of single-digit approval rates show that the demand for these loans far exceeded supply. Surveys also showed that over half of small businesses did not apply for the program. The impact this program will have will be limited to the sub-10% of firms who were able to apply and received funding. For these reasons we believe these efforts will have a minimal impact.

Large Business Bailouts

Magnitude: $425B

Expected impact: Moderate

If the Great Recession back in 2008 provides any indication of how businesses react in an economic crisis, we would expect to see minimal investments resulting from this influx of capital. Look for large firms to horde cash and to begin investing significantly only once the U.S. economy is well into a recovery. This leads us to expect a moderate impact from this portion of the stimulus.

Individual Stimulus Checks

Magnitude: $300B

Expected impact: Moderate

Cash in the pockets of the American public could be a great way to provide a crutch for consumer spending, but based off past behavior we would expect to see a significant portion of stimulus dollars held in savings or used to pay down existing debt. Neither of which would help consumer spending levels. There is also the issue of restaurants and bars being closed for an extended period. Spending on food (away from home) accounts for about 6% of the average American’s budget. Spending on gasoline accounts for 3.4% and entertainment spending accounts for another 5%. Combining these gives a worst-case headwind of over 14%. Bringing these factors together, we believe Americans will be somewhat hesitant to spend due to continued economic uncertainty and even the ones who do want to spend, will be limited by the availability of things to spend on. For these reasons we expect to see a moderate impact from cash stimulus to individuals.

Unemployment Boost

Magnitude: $260B

Expected impact: Moderate

On average, those receiving unemployment insurance receive $378 per week but this varies per state (from a low of $213 in Mississippi to a high of $555 in Massachusetts). Through July, the CARES act adds $600 per week to existing benefits, bringing the average unemployment benefit to $978 per week. According to the BLS, the average weekly earnings of wage and salary workers was $933 (seasonally adjusted). Currently the 2Q20 unemployment rate is estimated to be 32% by the St. Louis Federal Reserve. A large portion of the U.S. workforce will be receiving income of the same amount or more than they were while they were employed. This stimulus portion will help stem the bleeding but as it is only authorized through the end of June, and for reasons described in the individual stimulus check section, we believe this stimulus will only have a moderate impact.

Federal Reserve Actions

Quantitative Easing

Magnitude: March 15th: $700B ($500B for U.S. Treasurys and $200B for mortgage-backed securities) March 23rd: Unlimited

Rate Cuts

Magnitude: Target rate of 0 – .25%

Repo Market Intervention

Magnitude: Unlimited

Expanded Discount Window Access

Magnitude: Rate lowered to .25% and length of loans expanded from one to 90 days.

Expected combined impact: High

Quantitative easing by the Federal Reserve has the goal of providing liquidity to the market by providing a buyer for U.S. Treasurys and mortgage-backed securities. The goal of reducing interest rates is to incentivize borrowing and then investment, but the second step is often ignored by corporations during times of high uncertainty. The repo market provides short term capital to dealers of government securities (e.g. large banks, hedge funds, brokers). This acts as a valve on the money supply. When rates are low it encourages banks to sell securities back to the government thus raising cash and increasing the money supply in general. The Federal Reserve began intervening in the repo markets back in September 2019. At the beginning of 2020, their plan was to taper off this activity but as the virus took hold in the U.S. the Fed reversed course. The discount window is essentially the last resort for banks to secure liquidity as those that used it signaled potential imminent liquidity risk at that bank. The Fed reduced this stigma in mid-March 2020 by changing its disclosure practices. This caused an immediate spike in borrowing by banks.

Overall, we expect that these relief efforts will have a moderate impact on mitigating the fallout from this pandemic. Significant liquidity has been introduced into the system which has so far kept credit flowing but the recovery is up to the consumer to feel confident spending again.

The Shape & Depth of the COVID-19 Downturn

We have a broad shutdown of the U.S. economy during the mitigation phase, which will partially lift during the adaptation phase, ultimately opening broadly during the return to growth phase. This pandemic is having varying affects across industries causing some to be almost entirely closed while others are more active than they have ever been. We expect to see moderate impacts from the U.S. government’s relief efforts which are essentially a tourniquet while we wait for medical advances. Uncertainty will likely remain elevated through the end of 2020 and into 2021.