Executive Summary

The global spread of COVID-19 has impacted the economy with extreme speed and severity. The pandemic has caused consumer spending to contract and has increased unemployment, leading to an economic recession beginning in February. The Federal government and the Federal Reserve have both provided unprecedented aid.

Looking ahead, our Base case scenario is for a slow return fueled by the U.S. consumer gaining confidence through employment gains and increased consumption. It will be a slow, multi-year return. This pandemic will continue to varying affects across specific industries, causing some to be almost entirely closed while others are more active than they have ever been.

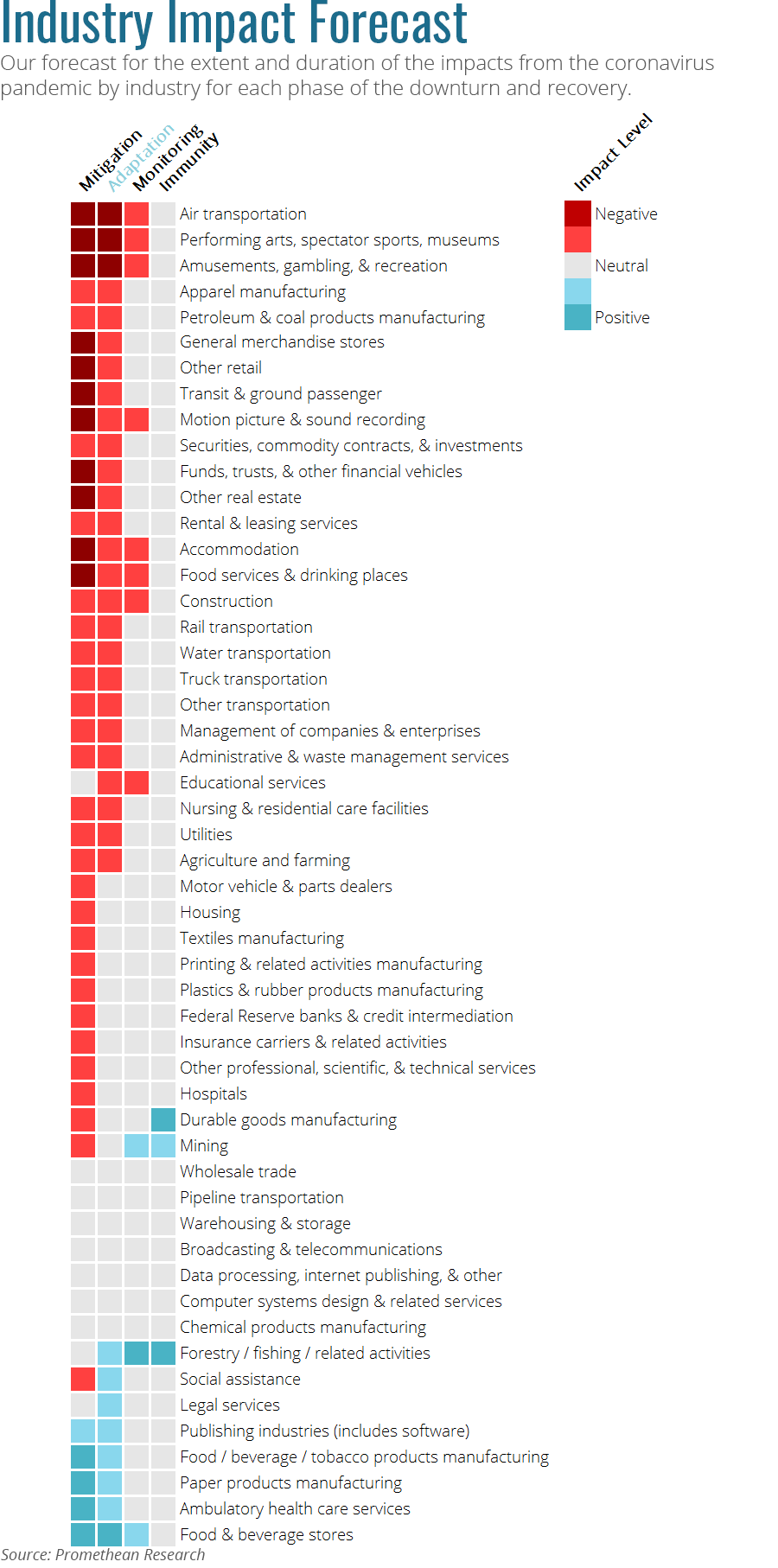

The U.S. is now exiting the Mitigation phase and is entering the Adaptation phase. This is slightly behind our original expectations of exiting the Mitigation phase at the end of the second quarter. Based on the latest information on vaccine and therapeutic progress, we are updating our phase expectations accordingly:

- Adaptation: Tail end of 3Q20 through the end of 4Q20

- Return to Growth – Monitoring: Beginning of 1Q21 through 2Q21

- Return to growth – Immunity: Beginning 3Q21 onward

In light of this, we are providing an update to our industry forecast. Most notably we are expecting significant improvements to Forestry / fishing / related activities and to Insurance carriers & related activities. We now expect a worse environment for Nursing & residential care facilities.

What Has Changed

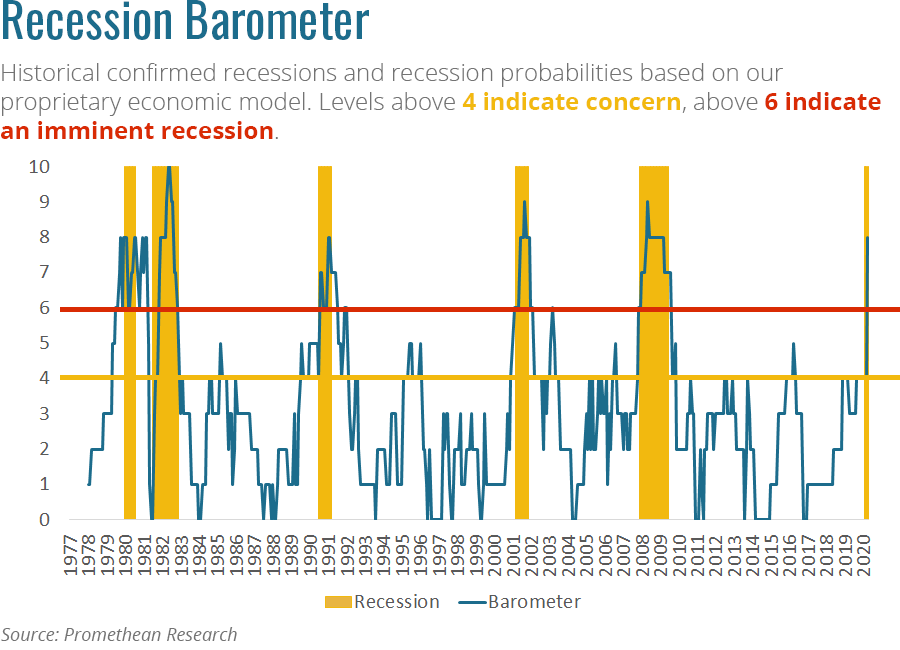

In January, our economic expectation was for “more of the same” with the U.S. economy experiencing modest economic growth. Our forecast lasted only a month and half, until it was quickly derailed in February by the global spread of COVID-19. The speed and severity of the global pandemic’s impact on the economy has been incredibly difficult to comprehend. The virus led to the U.S. economy contracting with a recession beginning in February as determined the National Bureau of Economic Research. Our Recession Barometer confirmed the recessionary conditions beginning in March and continues to show recessionary conditions are present.

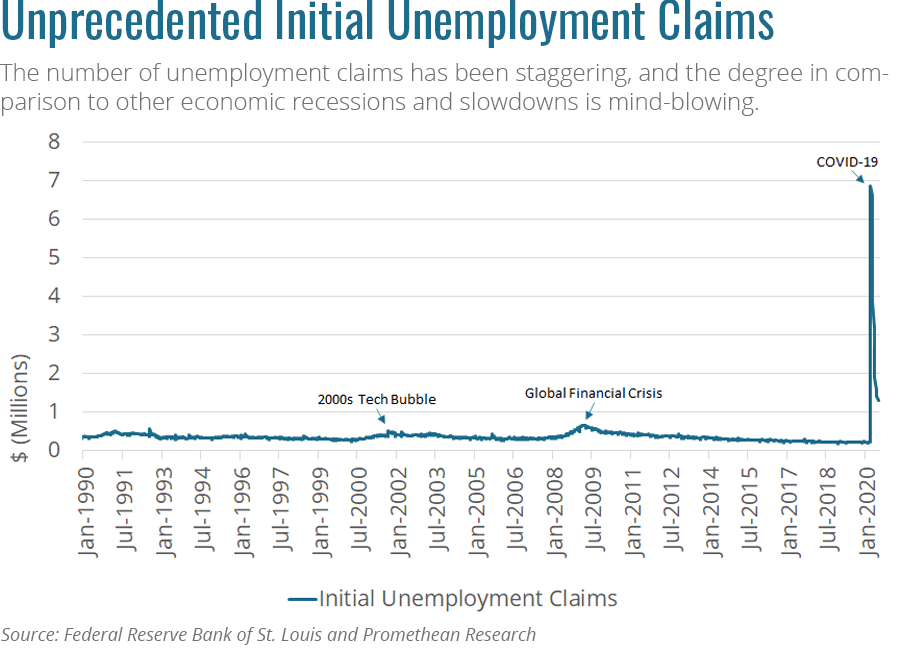

We remind our readers that the consumer is the backbone of the U.S. economy, and therefore we spend a significant amount of time analyzing any changes to consumer behavior. In an attempt to slow the spread of the virus, stay-at-home orders were put in place by multiple states beginning in March, which led to a historic increase in the number of unemployment claims as a significant number of businesses were forced to close or reduce their workforces. The number of unemployment claims has been staggering, and the degree in comparison to other economic recessions and slowdowns is mind-blowing.

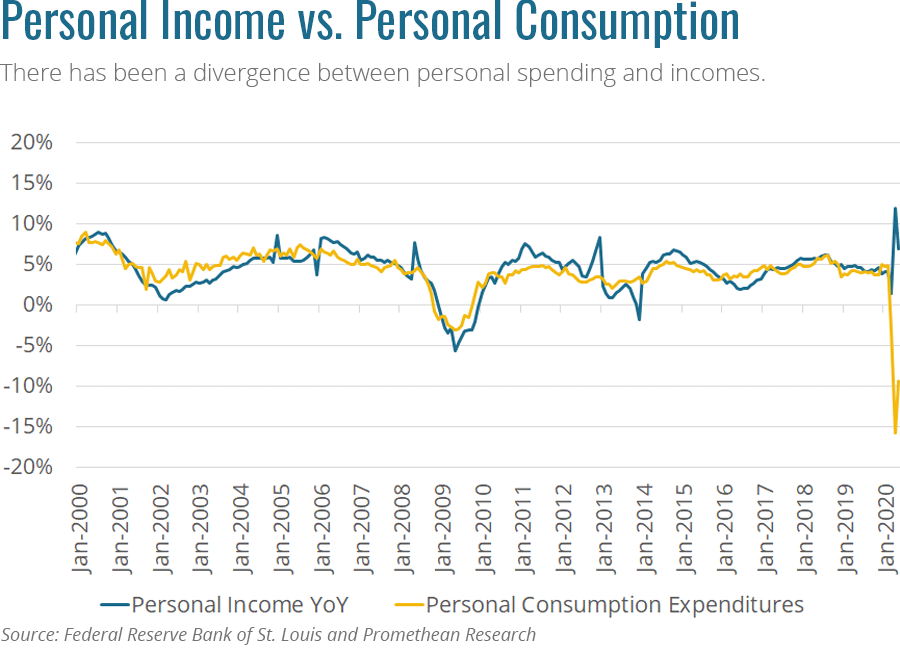

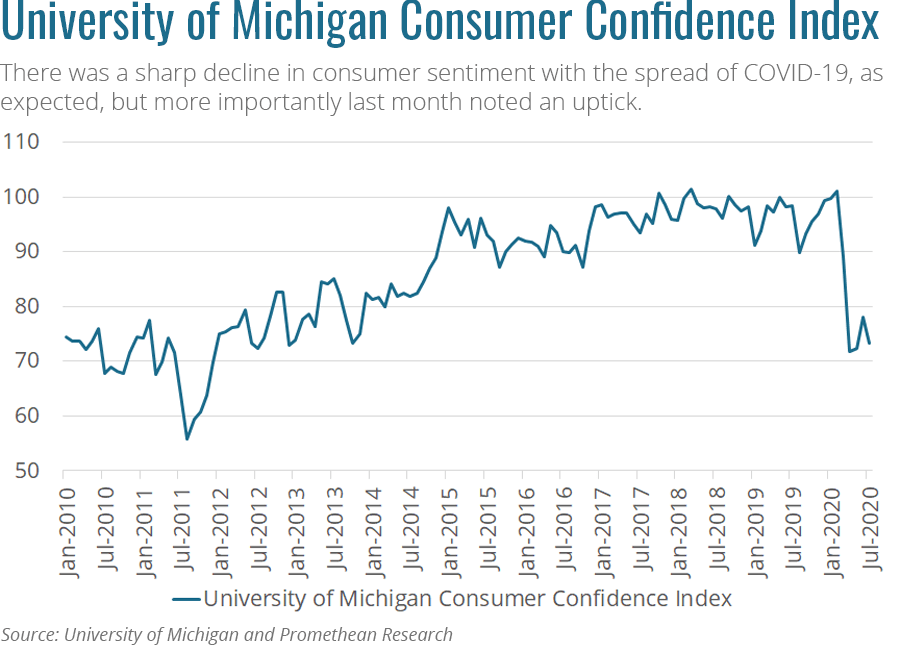

The increased unemployment has obviously led to decreased personal consumption as consumers reigned in spending due to uncertainty about their future paychecks and economic prospects. Knowing the importance of the consumer, the U.S. federal government quickly responded with the stimulus checks in an effort to support the U.S. economy. Even with the stimulus checks and the increased unemployment benefits, there has been a divergence between personal spending and incomes. We are closely monitoring the quickness that consumer spending returns as it will dictate the speed of the economic recovery. Fortunately, longer-term consumer confidence indices have remained elevated and the U.S. consumer remains relatively optimistic about the future given everything that has happened during the first half of 2020.

Looking Ahead

These are the times that a crystal ball looking into the future would be extremely helpful and since we do not have one, we have to weigh different outcomes. Most financial pundits and economist are trying to alphabetize the recovery, whether it is a U-shaped, V-shaped, W-shaped. Thankfully, no one has called for a Greek Kai or Kappa-shaped recovery (ϗ or ϰ), with a sharp decline, followed by a slow growth period and then another decline.

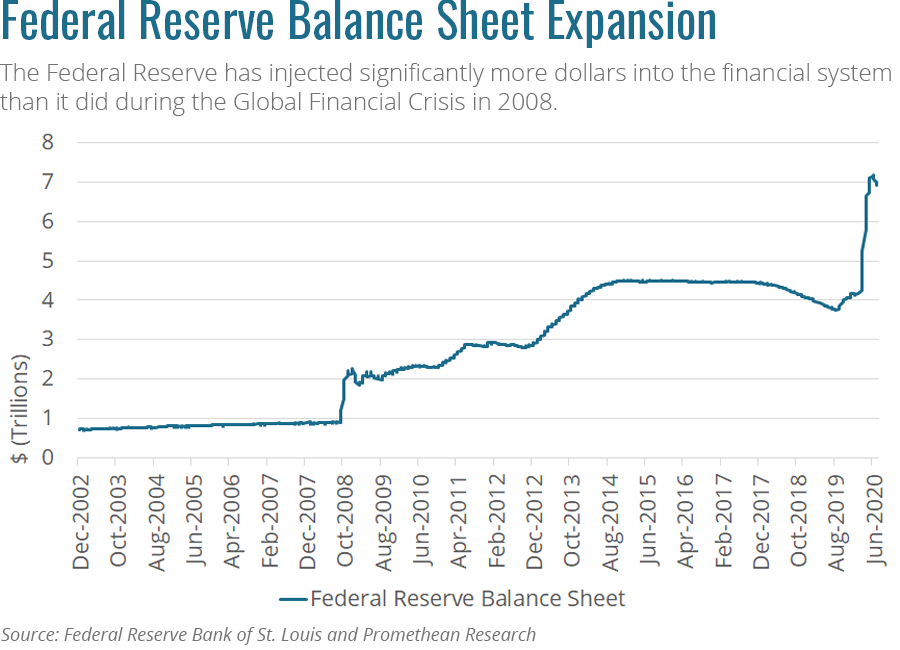

The Federal Reserve has been quick to action by pumping trillions of dollars into the economy. The chart below shows the amount of dollars and the speed that it has flooded the economy. The Federal Reserve has a dual mandate to achieve stable prices and maximum sustainable employment. There are arguments about the methods that the Federal Reserve is currently taking, but Chairman Powell and the Board Governors are using every tool in their powers indicating the severity of potential economic downturn. The Federal Reserve has injected significantly more dollars into the financial system than it did during the Global Financial Crisis in 2008.

We will be paying close attention to consumer sentiment and spending over the next couple months. There was a sharp decline in consumer sentiment with the spread of COVID-19, as expected, but more importantly last month noted an uptick. This will determine the speed and shape of the economy. The quicker the U.S. consumer regains trust, whether adapting to the new normal, a vaccine, or whatever reason, will be the cure for the economy.

The outlook and potential scenarios are numerous and very fluid depending on the moment. Our Base case expectation is for a slow return fueled by the U.S. consumer gaining confidence through employment gains and increased consumption. It will be a slow, multi-year return with the linkages between industries not leading to a domino effect of downturns, like what was experienced during the global financial crisis in 2008.

The Worst case scenario is for the recent positive consumer confidence data point being a head fake, and the U.S. consumer becomes concerned leading to less spending driven by a multitude of reasons. The Best case scenario is really hard to imagine right now with the state of California reissuing closures and a number of states hitting record number of cases.

In our May report, we highlighted industry impacts and roadmap for navigating this uncertain time. This pandemic will continue to varying affects across specific industries, causing some to be almost entirely closed while others are more active than they have ever been. We expect to see moderate impacts from the U.S. government’s relief efforts which are essentially a tourniquet while we wait for medical advances. Uncertainty will likely remain elevated through the end of 2020 and into 2021.

Affected Industries

This downturn has disproportionately affected many different industries and recoveries will be varied. The most seriously affected area so far (as of March 2020 data) has been Leisure & Hospitality, but we expect to see significant issues in other industries as the dominoes fall following the economic shutdowns. Here we provide our outlooks, by industry, for each phase of the downturn. See below for a quick analysis of each industry.

Agriculture, forestry, fishing, and hunting

We initially expected slight downside risk to agriculture with supply chain issues. Those issues have become more pronounced and we are now shifting our risk in this area higher. This will likely be offset by strength in forestry as lumber prices have increased substantially. This has prompted us to improve our outlook substantially here.

Mining

The dual challenges faced here by COVID-19 and the oil price war weighted heavily on oil and gas extraction. Although there has been some price recovery, our expectations remain firm that this industry will fare only slightly better during the Adaptation phase but will not return to growth until 1H21 due to continued pressure from a surplus in supply. A potential bright spot for the industry comes from surges in metal commodity prices that we expect will come into play during the Return to Growth phase.

Utilities

Utilities took a hit during the Mitigation phase and our expectations of a small rebound upon reopening seem over-optimistic. As the reopening re-closes due to poor pandemic management, we expect this area to remain under pressure.

Construction

We expect an initial slowdown here that should persist through the Adaptation phase as parts of the industry were initially shut down. We expect these impacts to ease during the early Return to Growth phase with a noted lag in demand for new office space offset by a potential increase in infrastructure spending. Should housing continue its strong growth, this area could pull ahead more quickly.

Durable goods manufacturing

This industry experienced a major slowdown during the Mitigation phase that we originally expected to last through the Adaptation phase. The stimulus checks appeared to have done their job though as durable goods have already begun to rebound. The effect of this look to be short lived though as stimulus and additional unemployment benefits end. We are leaving our outlook unchanged but note the potential for sooner upside.

Nondurable goods manufacturing

- Food and beverage and tobacco products saw a major uptick during the Mitigation phase, and we expect this will continue, to a lesser extent, through the Adaptation phase. This area should normalize during the Return to Growth phase.

- Textile mills and textile product mills experienced shutdowns and weak demand during the Mitigation phase, but we expect a rapid return to normal with a socially distanced workforce and advanced automation.

- Apparel and leather and allied products experienced shutdowns during the Mitigation phase but some of this was offset by a shift to production of PPE

- Paper products manufacturers experienced an initial positive impact during the Mitigation phase and we are leaving our expectations unchanged for the Adaptation and Return to Growth phases. Roughly half of the global paper market by weight is comprised of packaging which we believe will experience an increased demand as more retail trade occurs online and transactions are shipped again individually.

- Printing and related support activities realized an initial negative impact during the Mitigation phase but should normalize throughout the rest of the pandemic. Significant portions of the outputs from this industry flow into other manufacturing areas which should experience early challenges, but we expect them to fade rapidly by the end of the Adaptation phase.

- Petroleum and coal products suffered a double blow during the Mitigation phase as shutdowns and a price war in oil. As oil prices collapsed in March 2020, the demand for refining fell as well. As far as the impact here from the pandemic, we expect shutdowns to ease and impacts to decline by the Return to Growth phase.

- Chemical products experienced a slight positive impact during the Mitigation phase as demand increased sharply for soaps, hand sanitizer, and pharmaceutical manufacturing. We still expect this positive impact should dissipate during the Adaptation phase as demand tapers.

- Plastics and rubber products activities will likely see negative impacts due to the shutdown cascading through end markets during the Mitigation phase. These will likely be partially offset by increased demand for PPE (face shields and gloves). These factors should net out to a minimal impact during the Adaptation and Return to Growth phases

Retail trade

As the U.S. experienced a 33% decline in vehicle sales during the month of March, a 38% MoM decline in April, and then a 110% growth in May. They are currently back to pre-pandemic levles. We expect this was likely due to a significant stimulus spend by consumers. The absence of this stimulus will likely lead to negative impacts in the Motor vehicle and parts dealers industry and we do not expect this downside risk to dissipate until we are past the Adaptation phase.

Food and beverage stores experienced positive impacts during the Mitigation phase which we still expect to continue through the Adaptation phase as consumers remain hesitant, or unable, to shift their spending back to restaurants.

General merchandise stores and Other retail saw massive drops in revenue during the Mitigation phase as many were forced to close indoor operations and move to a curbside model. Going forward, consumer’s hesitancy to spend, due to uncertainty around the economy, will weigh on this industry. We still expect to see these effects lessen during the Adaptation phase and finally become negligible in the Return to Growth phase.

Transportation and warehousing

Air transportation will have the toughest time of the group with major hits from drops in consumer and business travel demands. Travel bans will add additional pressure here. We still expect to see significant negative impacts in this space through the Adaptation phase and even well into the Return to Growth phase. Rail, water, and truck transportation experienced negative impacts from the decline in business activity and consumer spend. These impacts are likely to be partially offset by an increase in consumers shopping online. We expect these negatives to persist through the Adaptation phase and dissipate during the Return to Growth phase.

Information

“Publishing except internet (includes software)” should see a slight positive impact during the Mitigation and through the Adaptation phase because it includes software firms. The Motion picture and recording industry should see significant negative impacts from the pandemic as it typically requires content creators to be in close proximity in order to create the product. Couple that with the relatively short shelf life and the closure of theaters, and we still expect to see the negative impacts persist through the Return to Growth phase.

Finance and insurance

As risks remain, we are leaving our expectations unchanged. We are expecting to see significant challenges related to lending, both commercial and consumer, due to reduced creditworthiness from an unstable economy. This will weigh on banks even as they see an uptick in an increase in higher margin mobile and ATM transactions. These negative impacts will likely last though the Adaptation phase, clearing up in the Return to Growth phase. Reinsurers could be at risk if too many businesses file claims for revenue losses due to the pandemic which would strain the industry’s capital reserves. We see this persisting through the Return to Growth phase.

Real estate and rental and leasing

During the Mitigation phase, new home sales fell 15% M/M in March and another 5% M/M in April until rebounding 17% M/M in May. The significant increase in the unemployment rate is increasing the risk of defaults and reducing the ability of renters to make rent. We still expect for these negative impacts to lessen during the Adaptation phase and should dissipate substantially during the Return to Growth phase.

Professional and business services

Professional services are easily delivered remotely and much of the industry has experience in telework already. We expect to see minimal disruptions to the ability to supply services, but negatives on the demand side persist. A potential area of strength lies in Legal services during the Adaptation phase where many contracts (sales, lease, loans, employment, etc.) would be reconsidered. Audit and tax firms, while not immune, are resilient during downturns. We expect to see positives in consulting firms that are able to aid digital transformation projects that are now mission critical.

Administrative and waste management had demand disruptions from the closer of businesses during the Mitigation phase. We still expect this will lessen slightly during the Adaptation phase and then should dissipate through the Return to Growth phase.

Educational services

In our prior note, we voiced concerns over colleges being forced to offer remote classes during the Adaptation phase. It appears that a large majority of them are headed down this route. We therefore continue to expect to see significant downward pressure on their pricing ability. This, along with the lost revenue from sports and dorms will likely cause challenges to persist through a significant portion of the Return to Growth phase.

Health care and social assistance

We expected to see positive impacts for ambulatory services during the Mitigation, and less so during the Adaptation phase. These should taper during the Return to Growth phase as demand returns to normal levels. Many hospitals were forced to close elective surgeries during the Mitigation phase which resulted in staff layoffs. We expect this negative impact to be short-lived with elective surgeries resuming during the Adaptation phase. A slight headwind for Nursing and residential care facilities during the Adaptation phase comes from significant risks associated with nursing homes but we see this abating quickly as few alternatives exist. Social assistance programs will be relied upon heavily during this pandemic and funding typically lags in this area. We would expect initial declines to dissipate as funding arrives and hiring increases during the Adaptation phase.

Arts, entertainment, and recreation

This industry saw widespread shutdowns and it remains difficult to imagine a significant reemergence of demand before the risk of infection has declined. We expect to see continued headwinds here through the Adaptation phase, progressively lessening through the Return to Growth phase.

Accommodation and food service

A large portion of restaurants, a high volume / low margin business, were expected to close permanently during the Mitigation and Adaptation phases. A recent economic report by Yelp revealed that over 50% of restaurants that were originally closed temporarily, have closed permanently. Continued challenges from weak expected demand will likely persist though the Adaptation phase. Growth here will likely be slow and we expect it to lag other industries during the Return to Growth phase.