2020 Economic Outlook

It’s all about the consumer

Published: February 2020

Executive Summary

Last year, we noted end market users could potentially reduce “discretionary” spending categories (i.e. advertising, technology, and other variable cost areas) due to the uncertainty of the economic climate. This led to our recommendation of tightening up budgets and increasing contact with customers while still investing in growth to make sure that your business will prosper regardless of the economic environment. Going forward, we are expecting more of the same type of economic growth, therefore our recommendation is to continue to invest in prudent growth.

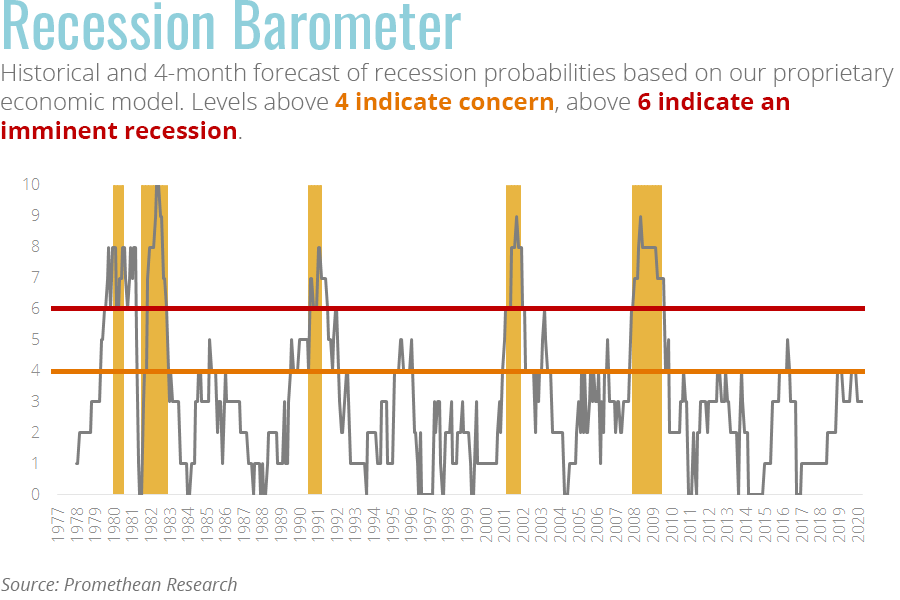

Our proprietary recession model predicts a low probability of a recession occurring in 2020, and we expect more of the same – low growth, lots of positive and negative noise along with employment and wage growth. The U.S. consumer has been the key supporter of economic growth, driven by employment and wage growth.

A Year of Tepid Growth

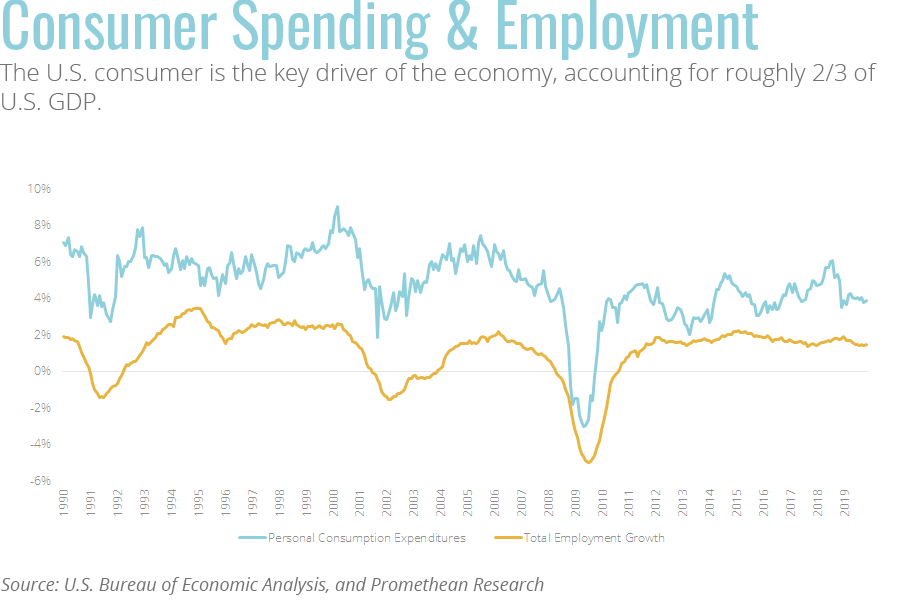

Before looking forward to 2020 expectations, we need to review 2019 economic events in addition to our 2019 forecasts and recommendations. The U.S. economy achieved mid-2% economic growth during the first three quarters of 2018, with economist predictions for the fourth quarter of 2019 to moderate slightly to just under 2%. The consumer continued its “job” with personal consumption expenditures averaging growth of 4.0% y/y and employment growth of 2% y/y. The U.S. consumer remains an unstoppable force right now with wage and employment growth leading to spending. The U.S. consumer is the key driver of the economy, accounting for roughly 2/3 of U.S. GDP.

Last year included a lot of commentary within the financial and business media outlets about the possibility of economic slowdown leading to recession (highlighted in our 2Q report). Frankly, with the frequency we were reading about it, we were also a little concerned. Our Recession Barometer was also showing warning signs, but nothing above the recession threshold which gave us confidence in our recommendations to continue investing in growth initiatives. This paid off for clients as they were able to accelerate growth in a turbulent market.

After updating our proprietary economic model, it continues show a low probability of recession. While several indicators are “flashing” warnings, we have not reached the required threshold to give us serious concerns. Our Base and Best-case scenarios both show no signs of recession in 2020.

What’s To Come?

First, we do not expect a recession in the next year based on current economic data and expect more of the same type of growth going forward. There could always be a Black Swan event that could impact our forecast (both positively and negatively), but where the economic indicators are pointing, we would expect modest economic growth in 2020 with companies searching for ways to grow.

More importantly than what the domestic economy growth is expected this year is what does it mean for your business. The recent NFIB and University of Michigan Business indices are both positive with the expectations similar to the 1H19 and improved from 3Q19. This gives us confidence that business continue to invest cautiously towards employment and growth.

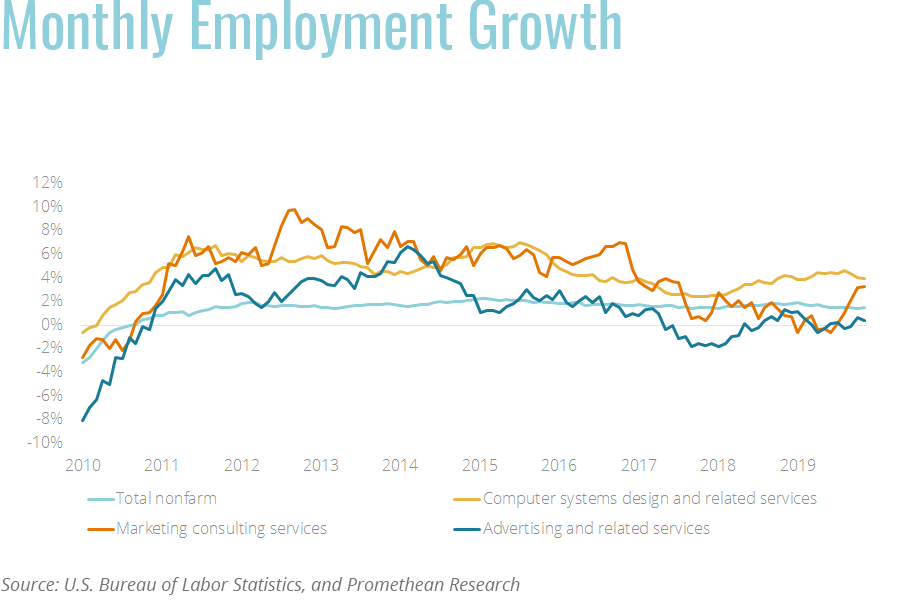

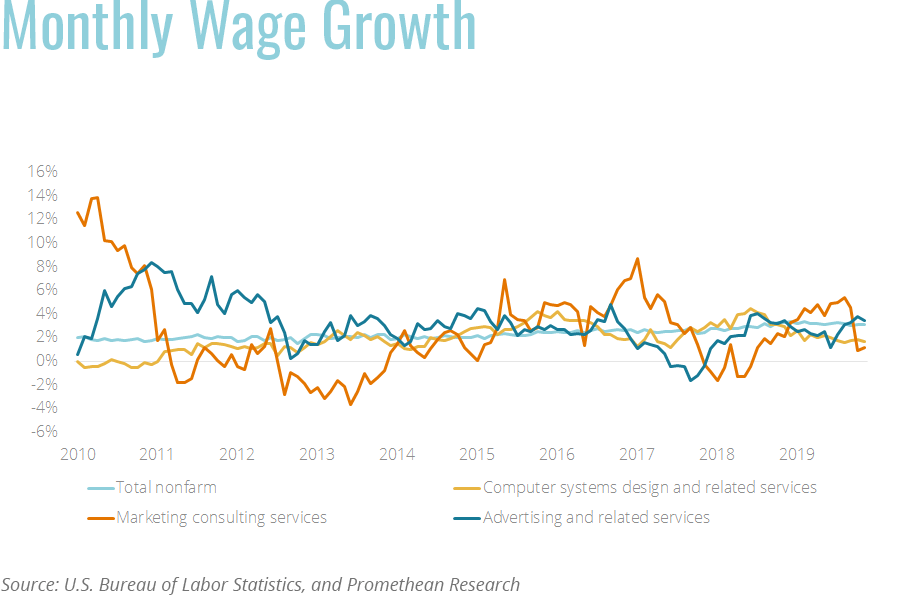

The largest expense category for digital service and digital marketing firms is employee expenses, which accounts for ~2/3 of total expenses. Employment and wage growth appear to be moving in line with the overall economy. Given the employment growth in the computer services and design industry (based on the Bureau of Labor Statistics), we would expect wages to grow in a similar fashion as in recent years. Advertising and marketing industries continue to bounce around from month to month, and we would not expect any deviation from last year’s trends.

About Our Model

We have created a proprietary economic model to gauge the potential for future U.S. economic recessions and to help us eliminate psychological factors that may sway us one way or the other. We have tested our model back to 1979 with it correctly predicting each recession and duration. We have analyzed hundreds of economic indicators to build a model that is comprised of multiple consumer, industrial, and global economic indicators. We have tested our model back to 1979 with it correctly predicting each recession and duration.

Stay Informed

Get the latest updates delivered straight to your inbox!