Recession Outlook Third Quarter 2019

The U.S. is unlikely to see a recession in the next 12-months

Published: August 2019

Executive Summary

Our proprietary recession model predicts a low probability of a recession occurring in 2019 and the first half of 2020, but the U.S. economy has become increasingly fragile throughout the year. The U.S. consumer has been the key supporter of economic growth, driven by employment and wage growth. However, the U.S. economy has wandered into a minefield. While each step forward leads to additional growth, one wrong step could plunge the U.S. economy into a recession.

Even though we are not forecasting a recession, it is important that businesses take precautions, especially with the current fragile state of the economy. As uncertainties mount, end market users could potentially reduce “discretionary” spending categories (i.e. marketing, technology and other variable cost areas). We suggest reviewing current financial budgets and customers to make sure that your business will prosper regardless of the economic environment.

Filtering The Noise

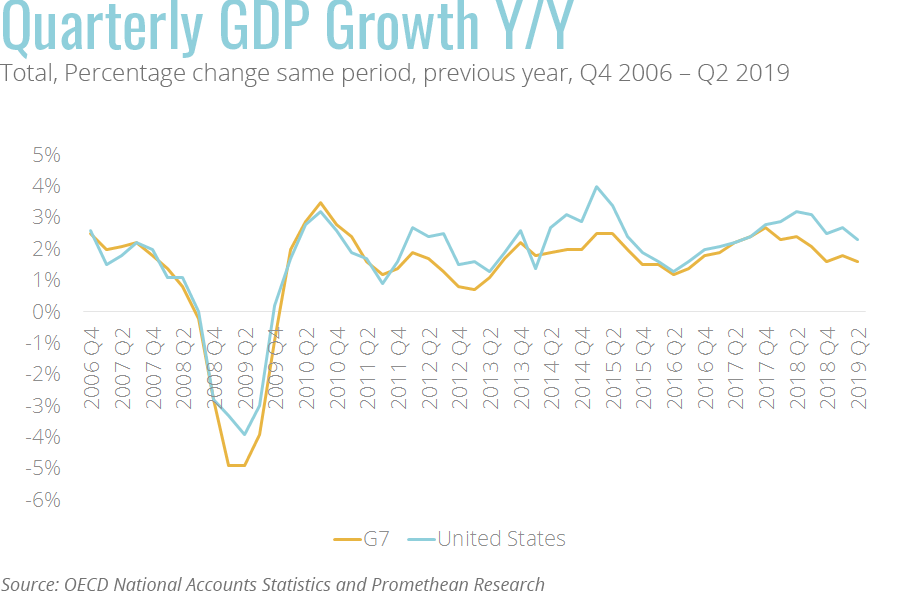

We are past the halfway point of the third quarter with the U.S. economic growth having decelerated through the first half of the year with first quarter GDP growth of 3.1% and second quarter GDP growth of 2.1%. The Atlanta Federal Reserve is currently projecting third quarter GDP growth of 2.2% growth and has been within a tight range since the initial projection between 1.8% and 2.2%.

Even the with the expectations of continued growth, the cautionary signs have become more frequent and more pronounced.

First, one of the most common indicators of economic recession is the inverted yield curve with the 2-year rate exceeding the 10-year rate several trading sessions. Our last economic update provides a brief overview of the inverted yield curve and the corresponding history with recessions.

Second, global economies are slowing, and manufacturing indices are pointing to further contraction. Through globalization, if one country sneezes, it can lead to the rest of the world getting a cold based on the financial systems and supply chains have become interlocked.

Finally, there is uncertainty with the escalating trade war between the U.S. and China (and occasionally the rest of the world). Financial markets and corporate planning do not handle uncertainty well. This has become the factor that could set off the minefield towards lower economic growth. For example, the economic slowdown in China and trade war rhetoric could lead to lower German exports and slower industrial growth. This could lead to Deutsche Bank needing a bailout and creating a financial meltdown that becomes exacerbated across the ocean to the U.S. or other international markets. Remember, economic forecasters have ideas of where the problems lie, but very few are able to point to a catalyst that starts the chain of events (or has reasons why it is different this time).

Economic Bright Spots

On the positive side, the U.S. consumer has been resolute with continued employment and wage growth. Consumers are not only maintaining their spending habits, but have also increased savings. The U.S. consumer is approximately 2/3 of U.S. GDP, and therefore a slowdown in industrial or manufacturing can be offset. Next, the Federal Reserve cut the Federal Funds Rate by 25bp in July, a feat last done with the financial crisis in 2008. The summary from the meeting indicates that reduction was to adjust based on current conditions, but not the start of a rate cuts.

Filtering through the noise and based on current economic data, we still expect the economy to grow through the remainder of this year and through the first half of next year. We expect the U.S. consumer to keep fueling the economy, additional rate cuts by the Federal Reserve, and for businesses to continue to spend to meet demand.

What’s To Come?

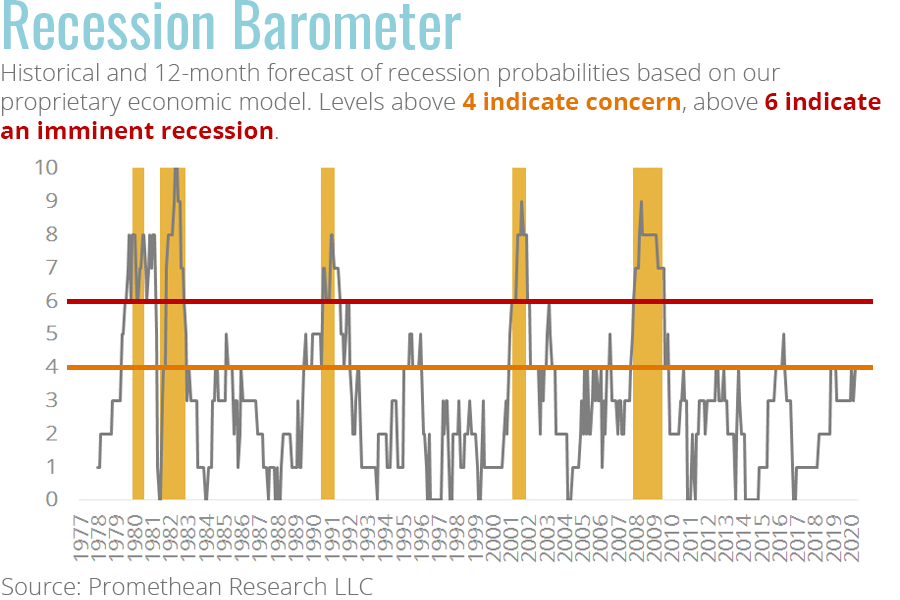

Our proprietary economic model currently shows a low probability of recession. While several indicators are “flashing” warnings, we have not reached the required threshold to give us serious concerns. Our Base and Best-case scenarios both show no signs of recession during the calendar year. Risks to our outlook include: the slowing global economy and the end of the Federal Reserve tightening cycle which have historically led to recessions. However, we are more concerned with the consumer sentiment and personal consumption expenditures falling to levels that would jeopardize the overall economy.

Preparing Your Firm

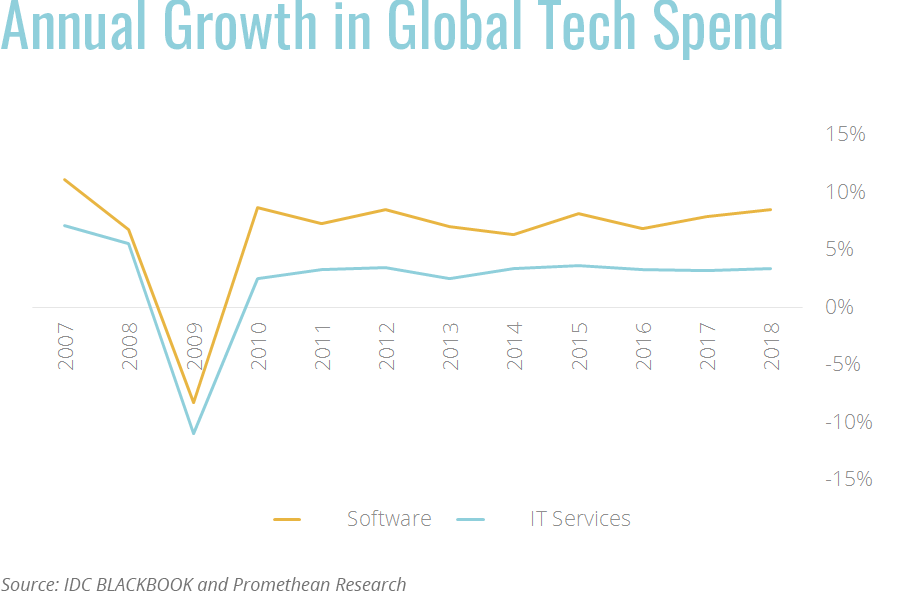

When there is uncertainty, normal behavior is to increase cautiousness and protection. Similar mannerisms are found in the way company’s operate. During times of uncertainty, many will reduce spending in areas that can provide growth and improve future outlooks. On the flip side, in times of exuberance, many will overspend believing that growth is inevitable. The chart to the left shows software and IT services spend before, during, and after the recession. Similar trends are can be found in advertising spend.

While we do not expect a recession in the next year based on current economic data, the uncertainty and noise could lead your customers to reduce or reexamine their spending plans. In this case, we recommend:

Increase contact with your client base to ensure strong communication about their future plans

Review your fixed versus variable costs and ensure your fixed cost base is only as big as necessary

Examine current accounts receivable to make sure customers are not paying later than normally do

Ensure moderate cash reserves are available and do not overly rely on lines of credit

Continue to invest in growth in an agile fashion so you can react to economic changes quickly

About Our Model

We have created a proprietary economic model to gauge the potential for future U.S. economic recessions and to help us eliminate psychological factors that may sway us one way or the other. We have tested our model back to 1979 with it correctly predicting each recession and duration. We have analyzed hundreds of economic indicators to build a model that is comprised of multiple consumer, industrial, and global economic indicators. We have tested our model back to 1979 with it correctly predicting each recession and duration.

Stay Informed

Get the latest updates delivered straight to your inbox!