Recession Outlook

First Quarter 2019

The U.S. is unlikely to see an economic correction in the coming year

Published: February 2019

Executive Summary

Our proprietary recession model shows a low probability of a recession occurring in 2019. Supporting the U.S. economic growth has been the expansion of employment and growth of wages, we expect these to continue throughout 2019. There are items that concern us, such as the slowing global economy, the Federal Reserve raising interest rates, along with the uncertainty regarding the U.S. government (whichever side you lean) with the current issues being the government shutdown and the international tariffs. We are viewing the current economic outlook as moderate, we won’t see high growth, but we don’t expect to experience an economic contraction either, just modest economic growth for 2019.

A Look Back

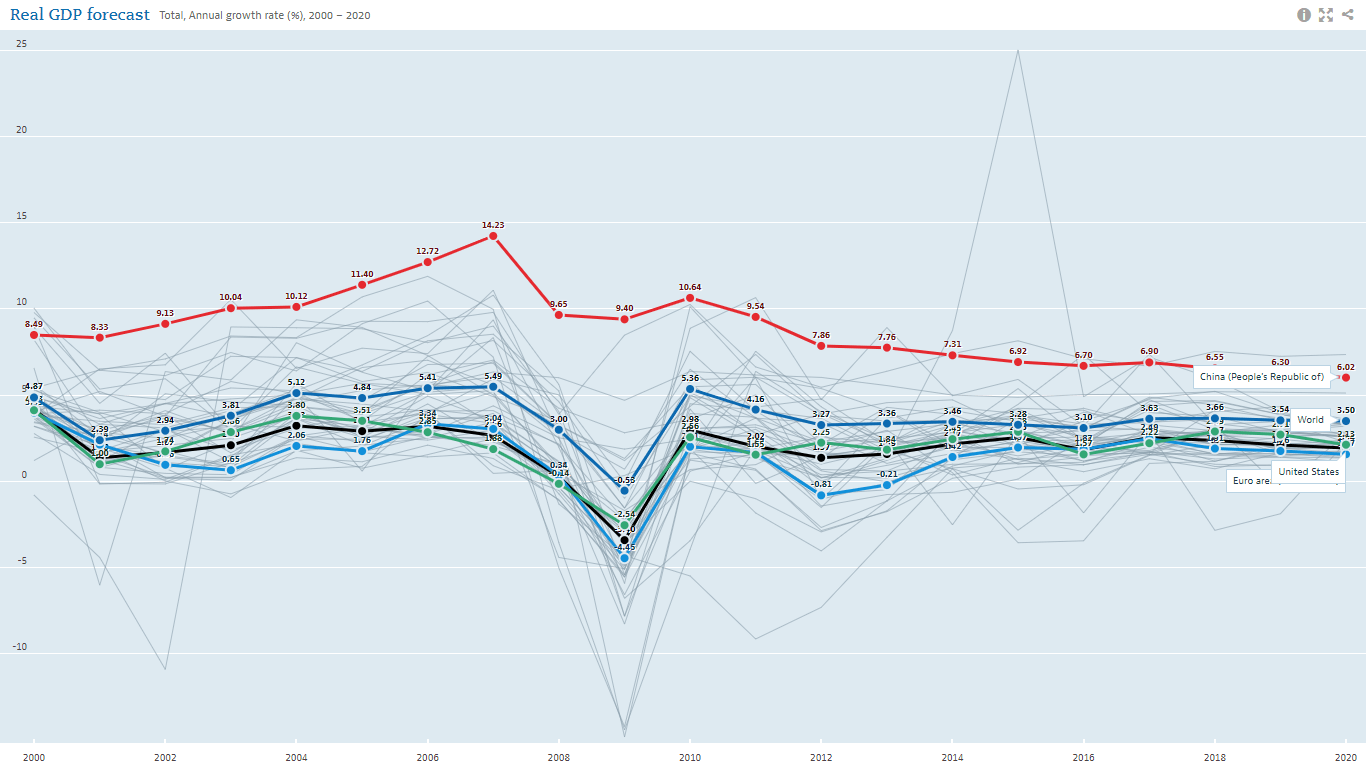

Before discussing our outlook for 2019, let us begin with a brief review of 2018. Two key highlights from last year were the growth of the overall U.S. economy and employment/wages. The U.S. economy achieved 3.2% economic growth during the first three quarters of 2018, with economist predictions for the fourth quarter to moderate slightly to just under 3%. The U.S. economic growth has been incredibly impressive and bucked the trend of the global economy as the Eurozone and China have both slowed.

Supporting the U.S. economic growth has been the expansion of employment and growth of wages. Employment growing in the low single digits has caused higher wages. More importantly, this has led to increased consumer spending, which has been able to overcome the global slowing. The fact is, you can’t bet against the U.S. consumer, which accounts for roughly 70% of U.S. GDP. Below are charts displaying the annual change in Personal Consumption Expenditures and Nonfarm Payrolls. PCE has been trending upward since 2010 and Payrolls have been flat since 2012.

What’s to Come

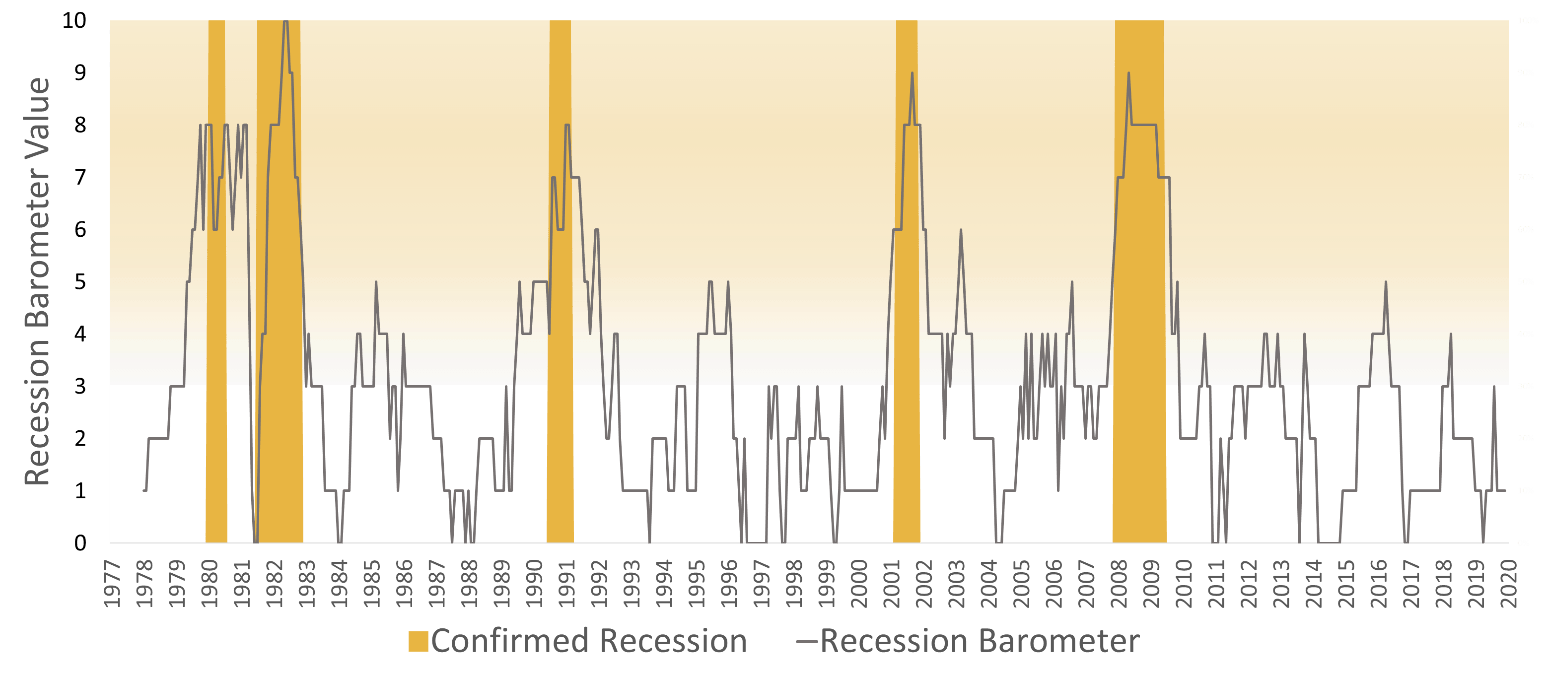

Now looking to the year ahead, the idea of potential recession has been tossed around a lot by the financial media and trying to keep track of all the economic data and what all the economic pundits is a daunting task. It was in the first days in the new year that the U.S. economic data along with press releases announcing the Chinese economy was slowing, which was going to pull the entire globe into an economic recession. These headlines were followed the next day a better than expected jobs report and commentary from the Federal Reserve chairman that raised outlooks. Recessions are very rare, but the fact that the most recent economic contraction was one of the worst in U.S. history, executives are understandably gun shy. Also, keep in mind that in the last four decades, there have been 5 recessions, or 61 months of contraction out of the last 468 months. Our proprietary economic model currently shows a low probability of recession during first half of the calendar year.

While several indicators are “flashing” warnings, we have not reached the required threshold to give us concern. Our Base and Best-case scenarios both show no signs of recession during the calendar year. However, our Worst-case scenario does show potential for economic contraction, but would not enter a slowdown until July at the earliest. There are items that concern us, such as the slowing global economy, the Federal Reserve raising interest rates, along with the uncertainty regarding the U.S. government (whichever side you lean) with the current issues being the government shutdown and the international tariffs.

Recession Barometer

We believe recession risks are currently overblown. GDP growth will decelerate in 2019 will cause the feeling of economic contraction. We would anticipate more of the same with growth in wages due to labor shortages in certain areas/industries/markets, and consumer spending supporting the economy. The tariffs continue to be challenging as companies retool supply chains and end markets, and we would not expect any significant changes until later in 2019 with just a lot of headline noise. Therefore, we are viewing the current economic outlook as moderate, we will not see high growth, but we do not expect to experience an economic contraction either, just modest economic growth for 2019.