State of Digital Services 2025

Executive Summary

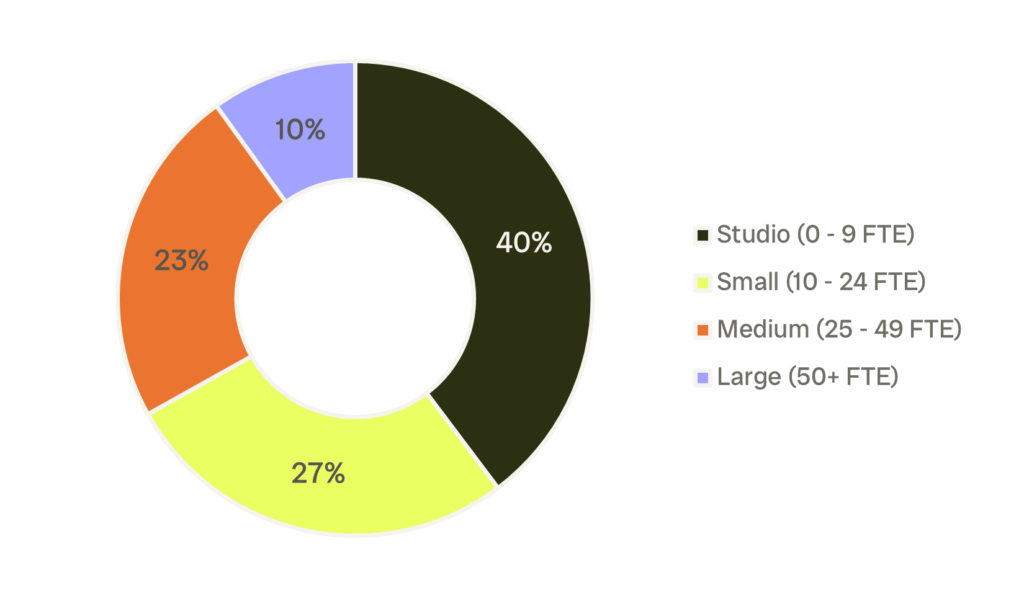

Digital agency growth stabilized in 2024 but varied by size. Studio shops returned to long-term growth levels, Small shops maintained slow but steady gains, and Medium and Large agencies experienced mild contractions for the first time on record.

Those that shifted or expanded their service mix saw far stronger growth than those that stood still or cut services. 84% identified as specialists this year and once again, the specialists outpaced their generalist counterparts when it came to revenue growth.

Pricing and revenue were closely linked. Agencies that raised rates grew more quickly and earned above-average margins, while fee reductions correlated with a 6% revenue decline. Value-based pricing again outperformed standard models, although it remained a minority approach. Agencies that transitioned into serving larger clients grew substantially faster than others.

Average agency headcount contracted in 2024, driven by a 10% decline at Small agencies. Agencies turned to contractors to offset this as we saw contractor use rise 19% on average. Total employee turnover rates sat at 23% overall, skewing higher for the smallest agencies.

Net margins stayed stable, with Studio shops earning a standout 19%. Industry-focused specialists outperformed generalists on margins, and expanding or shifting service mixes boosted profitability.

AI was the biggest disruptor. Most agencies implemented AI in copywriting and coding but moved more slowly in design, project management, and sales.

Economic and political instability were major concerns, shaping cautious client budgets and spurring nearly half the agencies to explore M&A.

Overall, adjusting services to meet market needs, specializing, and growing project and client sizes defined success in a challenging year.