Employment Trends: A Mixed Bag for Digital Service Firms

Expect continued moderate growth (no recession yet), but also expect payroll costs to outpace productivity gains.

Published: March 2019

Executive Summary

The importance of human capital is critical within the digital services industry. On average, 60-70% of a digital service firm’s costs are payroll related. Our 2019 Outlook report highlighted firms’ expectations to increase headcount, and we would expect the competition for talent to only increase. Current employment trends show that the demand for labor continues to outpace supply, which has lead to wage growth. Firms without the proper cost structure could have trouble handling the increased operating expenses associated with wage growth if their revenues and pricing do not adjust to the current environment.

Key Takeaways

- Employers are having to pay more in wages than they are receiving from increased output.

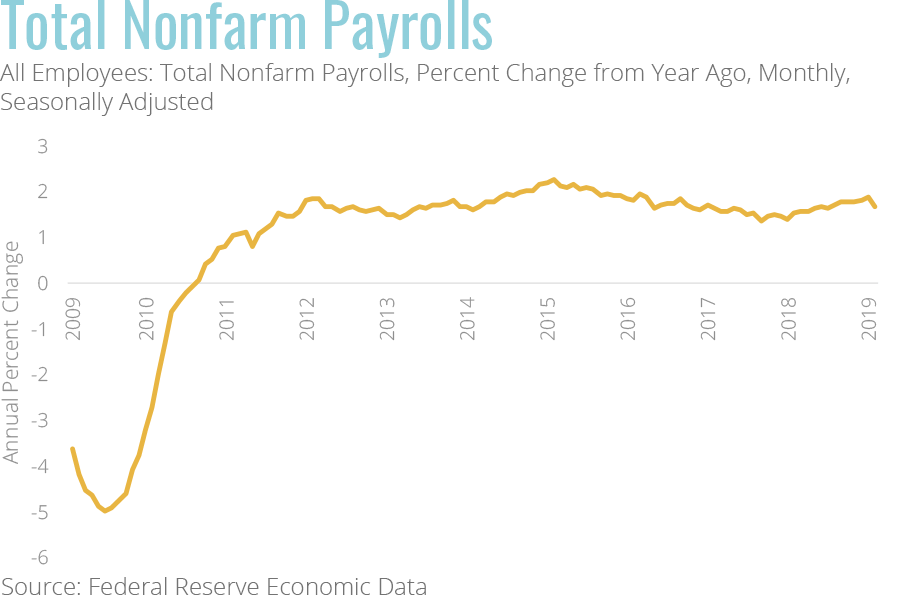

- U.S. employment growth during the first two months of the year has remained steady, inline with the last twelve-month average growth of 1.7% y/y

- Employment growth and wage growth are fueling the consumer. Consumer spending is key for economic growth, accounting for approximately 2/3 of U.S. GDP.

Yet Again, the Headlines Don’t Tell the Whole Story

During the past month, the current employment numbers have garnered quite a bit of attention. The monthly jobs report released on March 8 by the Bureau of Labor Statistics, posted a deceleration in employment growth and led to the U.S. stock market indices declining that day. The headlines of economic slowing and the dreaded R word (recession) crept back into commentary and outlooks.

Taking a step back from the headlines and taking some time to digest the information, it is true that the year-over-year change fell in February from January, but let’s examine a timeframe longer than a month to provide better context. Since 2016, total nonfarm payrolls have grown in the mid-1% to 2% annually since mid-2012 with ups and downs. Nonfarm payrolls capture the total number of people employed on a full-time or part-time basis. We track this snapshot of current employment since it ultimately leads to confidence and consumer spending, which generates approximately 2/3 of economic activity. The metric however excludes self-employed, farm workers, domestic workers, and non-civilian government employees. While one month can start a trend, volatility in these monthly reports is not a reason to cause panic and a change in business strategy.

Employment-to-Population Provides More Positive News

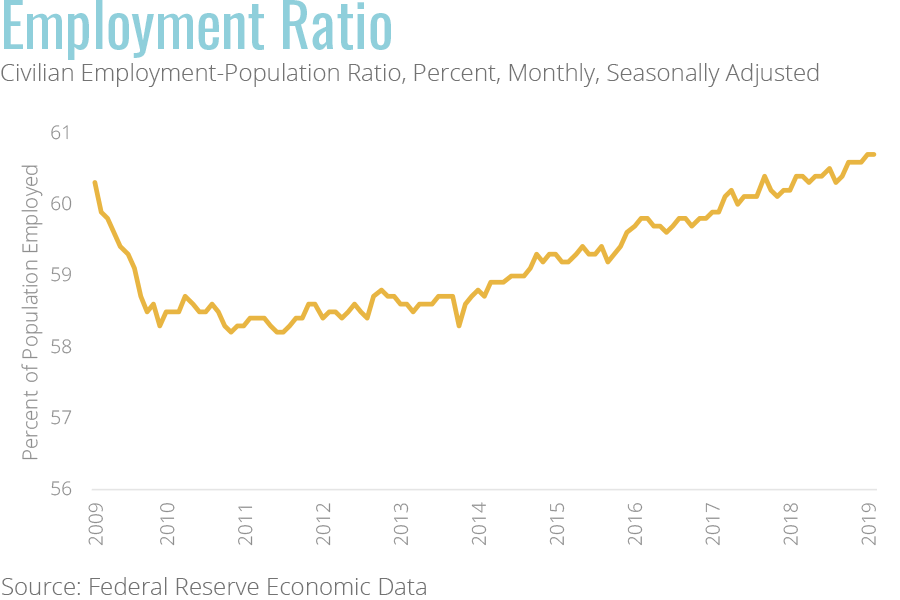

Another positive factor in the report was the employment to population ratio continuing to climb higher. The employment to population ratio provides a more complete picture by showing the total employment relative to total working age population. We prefer this metric over the unemployment rate as it removes the impact of individuals entering or leaving the workforce. The most recent data indicates 60.7% of the U.S. population is employed. While this is a cycle high-water mark, prior to the 2008 recession, the ratio topped 63.3%. In our view, the employment to population ratio can continue to increase and total nonfarm payrolls will continue to grow in conjunction, leading to continued economic growth.

Wages Are Rising Faster Than Output

One item from the report that may cause concern is the continued increase in average hourly earnings due to employment growth (demand) outpacing the number people entering the labor force (supply). If labor supply does not increase at the same rate as labor demand, then it causes wages to increase. Annual wage growth has now reached levels last seen ten years ago. The current dynamic has caused wage growth, which is a positive for the employees, however business owners that operate on thin operating margins will feel the pressure. Another item of interest, while wage growth has moved higher, employee productivity has remained relative stable. In other words, employers are having to pay more in wages than they are receiving from increased output.

Expect Continued Modest Growth This Year

Overall, we are not concerned by single economic data points. We will continue to pay attention to the indicators that could cause the trends to change, but at this time have not changed our expectations for modest economic growth in 2019. Look for the next update to our 2019 economic outlook and recession barometer in April.

Stay Informed

Get the latest updates delivered straight to your inbox!