Digital-first or Bust

Emerging trends and how shops can evolve to take advantage of them. Here we highlight some major shifts caused by this pandemic. The core theme revolves around how quickly the pandemic has forced firms to take a digital-first approach to their businesses. We then dive into major shifts in how companies are buying in today’s environment and how digital shops can tailor their solutions to fit.

The core driver of these changes lies in the speed that the pandemic has forced firms to take a digital-first approach to their businesses.

Ecommerce as the Main Channel

Timing: 2Q20 – Forseeable future

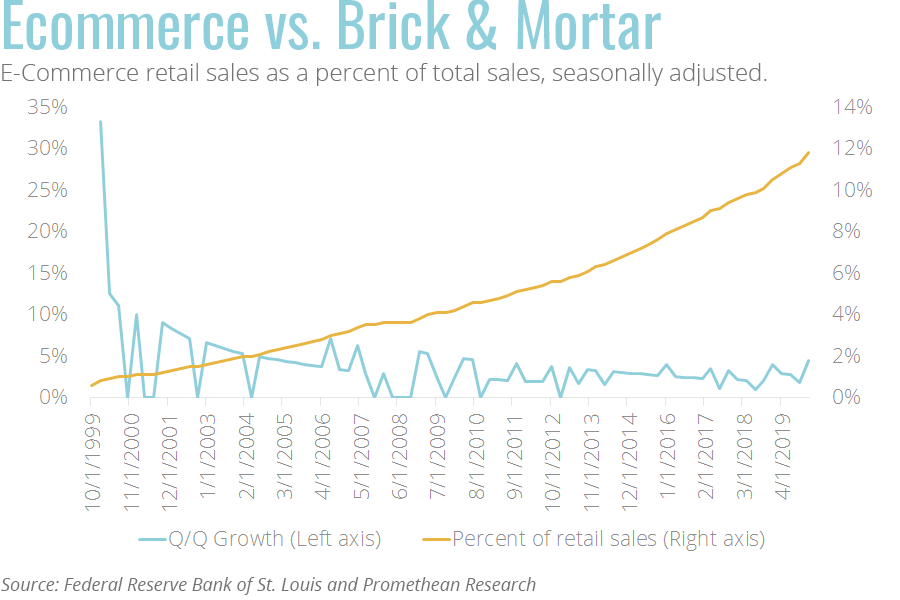

Ecommerce retail sales represented only 12% of total sales in 1Q20. Historically it has grown at a rate of 4% Q/Q, and we expect to see a significant jump in 2Q20 as consumers increased shopping online with the stay at home orders. Even as those orders are lifted, we expect a portion of this increase will remain.

We see significant opportunities for digital firms in the facilitation of better and more efficient ecommerce experiences. Everything from online storefronts to managing inventories, managing vendor relationships, customer acquisition, analysis and more can be improved.

Automate Everything

Timing: 2Q20 – 4Q21

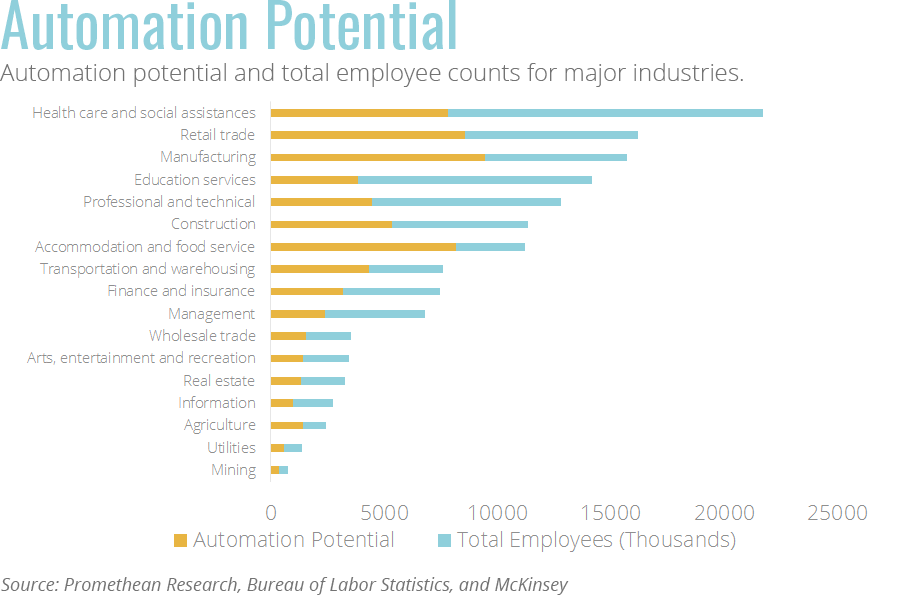

“Software is eating the world” has been true for decades and recent events are forcing firms to take yet another look at automation. A report by Forrester found that many companies plan to invest more in automation than rehiring as the pandemic fades. New social distance requirements place further pressure on firms that require employees to work in close quarters (factory and service jobs specifically).

This provides ample opportunities for digital firms to aid in automating old practices and processes.

What’s Left of Brick & Mortar Retail

Timing: 2Q20 – 2Q21

A U.S. focused IBM survey showed “…nearly 40 percent of consumers surveyed said they are likely to use contactless payment options via their mobile device or credit card when shopping.” and a global survey by Mastercard found that 79% of respondents are now using contactless payments. It appears the pandemic is finally increasing adoption of contactless payment.

In a blending of ecommerce and brick & mortar stores, curbside pickup has exploded. Wait times at grocery stores were up to a week in late April and Instacart (a shopping as a service app) announced it planned to add a quarter-million new workers in late April (in addition to the 300k new shoppers in March).

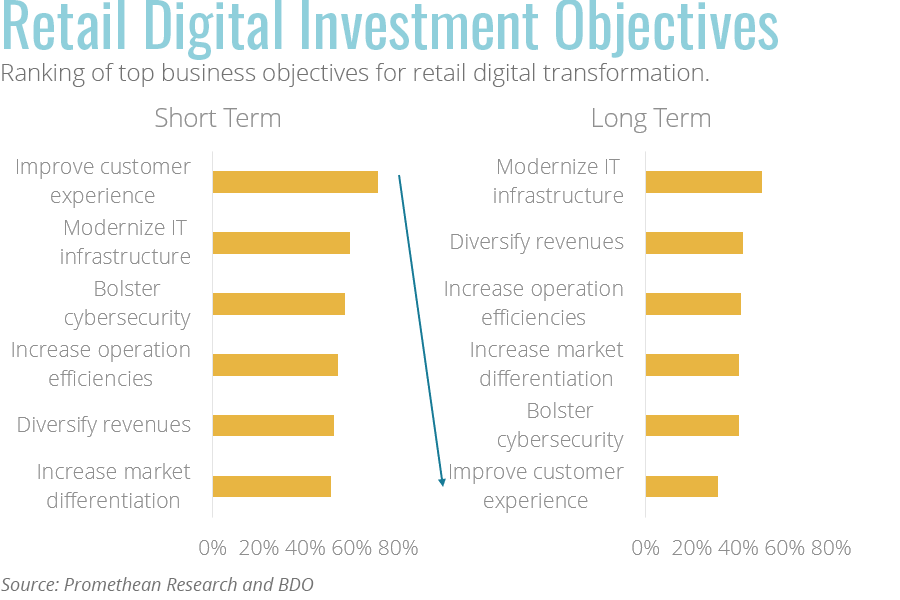

The entire digital transformation of the retail experience is on the table now and the timeline to implement is shrinking. Thinking beyond payments to other forms of contact; digital shops can help facilitate apps for associates and managers, training and education, shopper tracking, digital displays, employee monitoring, location sensing, and electronic labels.

Brick & mortar stores are using in-house, off-the-shelf, and custom solutions to facilitate curbside pickups and deliveries. Stores are accelerating the pace to have a functioning omnichannel presence. Optimization and efficiency will be demanded, which will allow digital shops to offer additional value.

Remote Work’s Time to Shine

Timing: 2Q20 – 4Q21

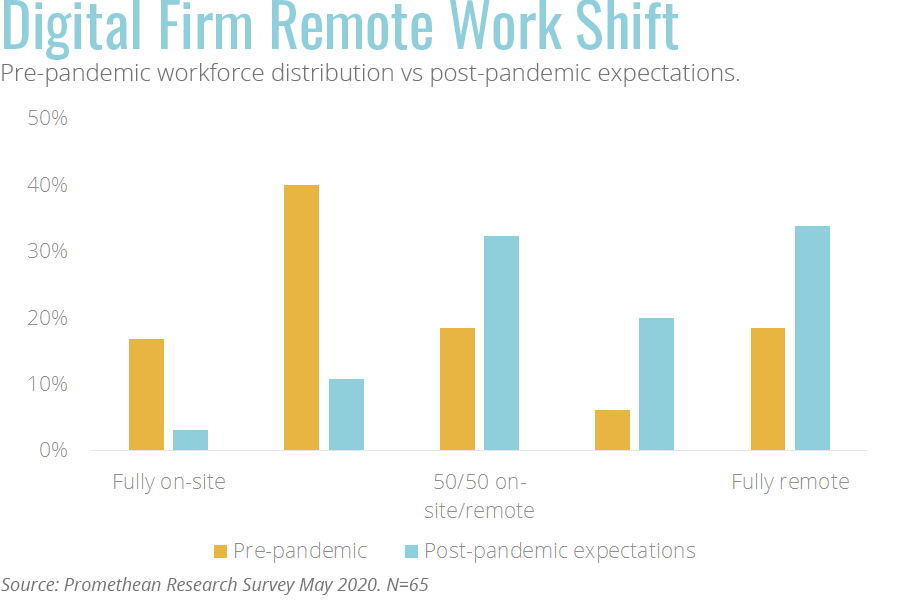

As firms were forced into a month-long remote work experiment many have learned that the benefits outweigh the risks. Firms that weren’t prepared for a distributed workforce likely had a tough time transitioning as states shut down which will further entrench negative sentiments towards remote work. On the other side, firms that were even somewhat prepared got to experience some of the major benefits of having a distributed workforce. On balance, we expect to see a moderate shift from standard on-site workforces to more remote workforces, even after the pandemic fades.

Twitter and Square (Facebook is also reviewing this possibility) announced that they will allow employees to permanently work-from-home even after the pandemic is gone. Other announcements from large tech firms indicated similar sentiments, at least for the rest of 2020. We are seeing from our own surveys drastic shifts in sentiment towards permanent remote work options.

Facilitating this via more effective communication and workflow apps and processes allow digital shops to provide significant value. As digital shops can be run completely distributed, this shift should make it easier to go remote. Take advantage of the increased talent pool, and the savings from eliminating or reducing rent and office expenses.

Telehealth +

Timing: 2Q20 – 4Q21

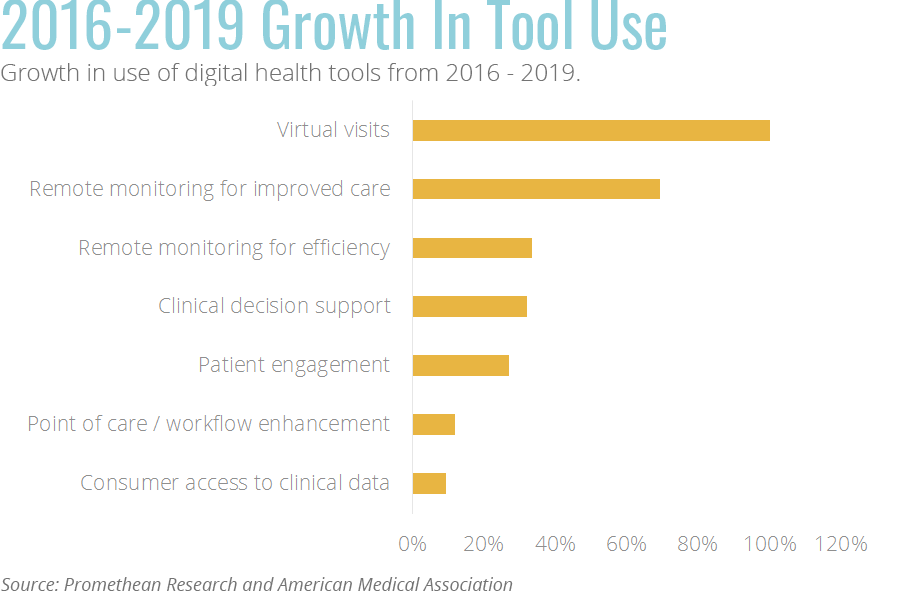

Prior to the pandemic, telehealth was growing rapidly. According to a survey by the American Medical Association, televisits doubled since 2016 to almost 30% of doctors adopting the technology at the beginning of 2020. We have seen this pandemic drive significant growth here as doctors work to provide care while reducing physical interactions.

The medical space presents its own set of challenges, but we see opportunities here beyond telehealth visits in the form of virtual waiting rooms, prescription management, remote monitoring, among others.

Digital-first or Bust

Client’s interests have changed and the way you deliver value must shift as well. This involves the types of solutions that are presented, how services are priced, and how quickly you can successfully implement solutions.

Companies are being forced to adapt quickly in this environment. If you architect your service offering in such a way that you can provide a rapid solution, even if it doesn’t have all the bells and whistles, it can put you in a better position than slower-moving firms.

Clients are in a risk averse mindset and as a result are much more interested in tried and true solutions. They are focused on protecting revenue and margins, rather than aggressively going after new business. Safe, efficiency boosting solutions will be attractive here.

Pricing is an area that requires some serious thought. By changing pricing too much here you risk devaluing your services, but too much rigidity could show a lack of understanding of the current environment. In our research, we have seen digital shops solve this by offering reduced prices, extending payment terms, offering more value engineering, and taking smaller initial projects.

By changing how you package your solution, you can position your firm to take advantage of the changes caused by the pandemic.