Summary & Key Findings

Digital shops wrapped up a tumultuous 2020 with solid revenue growth and margins. Average revenue growth of 10% Y/Y was led by Small and, surprisingly, Large shops where expanding project sizes provided strong tailwinds. Revenue per employee was up in 2020 vs. 2019 which indicates shops were financially healthier than many expected. We saw specialist shops (primarily specializing along verticals / industries rather than technologies / services) grow significantly faster than generalists providing another argument for specialization. This year’s survey also gave us new insight into the average composition of firms at different sizes which showed the growth of the importance of sales people as firm size increased. Pricing methods remained essentially unchanged from last year with the big three (Time and Materials, Fixed Bid, and Retainer) making up the majority of responses. New data from Summit CPA shed some light into the makeup of average overhead components and utilization rates. Average utilization rates for the year are a reflection of just how challenging 2020 was.

The big story here is how optimistic owners are for a strong 2021. From their average overall outlook through their revenue growth, client budget, and hiring expectations, digital shop owners are expecting a bright 2021.

Download The Full 22-Page Report

You’ll Learn

Average revenue growth rates by shop size in 2020

How project size changes correlated with growth rates.

If being a specialist shop had any impact on profitability or growth and how much.

The most common pricing methods digital shops employ.

Average profit margins by company size in 2020.

About This Report

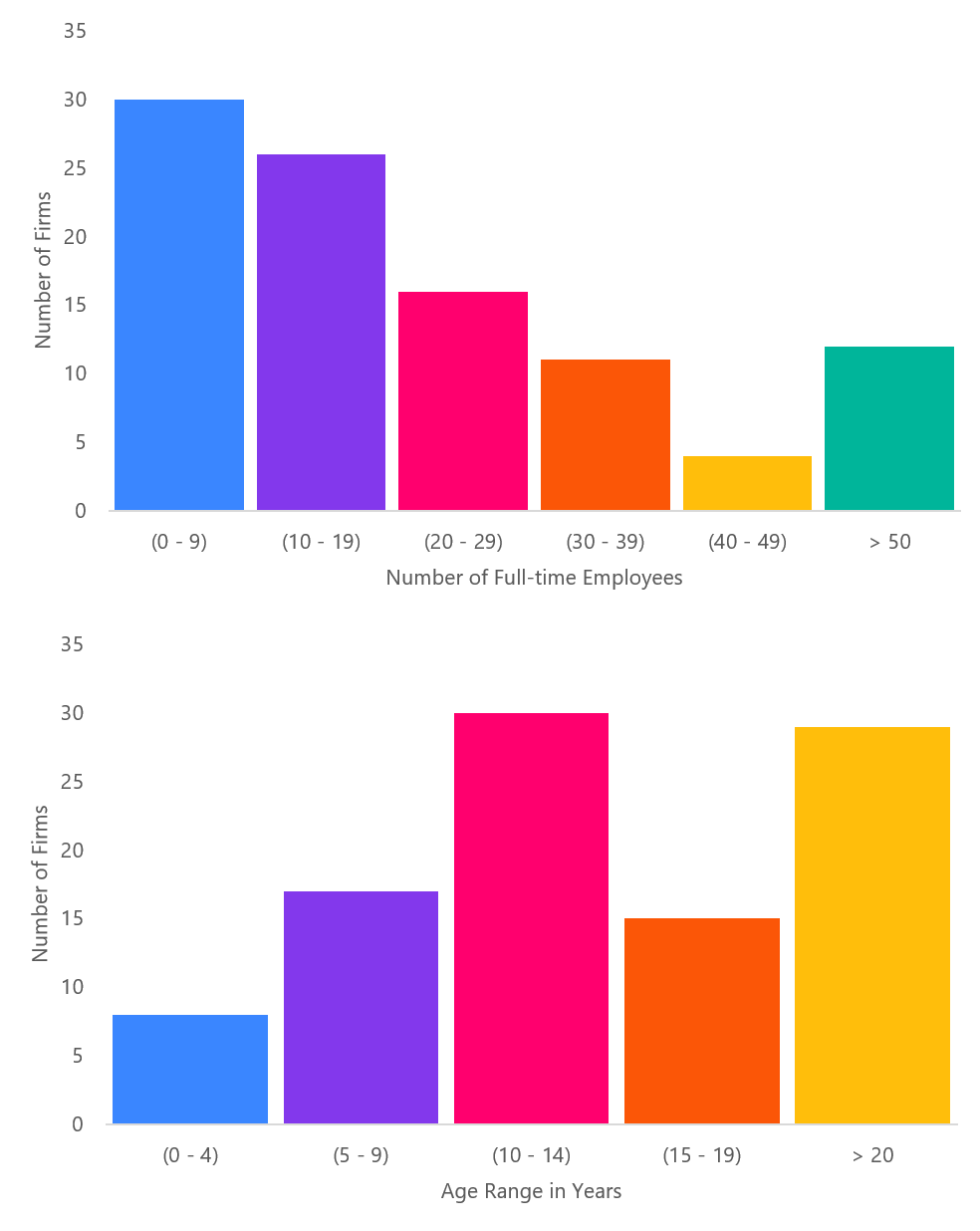

- 102 Responses

- Average size: 30 employees

- Median size: 16 employees

- Average age: 14 yrs old

This survey was open to the Bureau of Digital and Promethean Research communities during February 2021. It focused specifically on the outlook of digital shop owners and managers. Both the size distribution and age distribution of respondents fit with our view of how the overall digital services market is distributed.

52% of the shops identified as specialists which is up from 47% last year and 30% in 2018.

The average number of services offered remained unchanged from 2019 at 5. The most common services offered by shops in this survey were: Web design / development, UX design / strategy, Digital strategy, Mobile design / development, and App design / development.